Page 97 - Annual Report 2021

P. 97

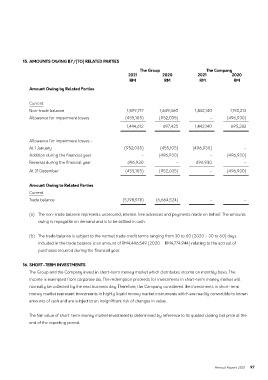

15. aMOunts OWing BY/(tO) rElatED PartiEs

the group the company

2021 2020 2021 2020

rM rM rM rM

amount Owing by related Parties

Current

Non-trade balance 1,899,717 1,649,460 1,442,140 1,192,213

Allowance for impairment losses (455,105) (952,035) - (496,930)

1,444,612 697,425 1,442,140 695,283

Allowance for impairment losses:-

At 1 January (952,035) (455,105) (496,930) -

Addition during the financial year - (496,930) - (496,930)

Reversal during the financial year 496,930 - 496,930 -

At 31 December (455,105) (952,035) - (496,930)

amount Owing to related Parties

Current

Trade balance (5,198,978) (6,664,524) - -

(a) The non-trade balance represents unsecured, interest free advances and payments made on behalf. The amounts

owing is repayable on demand and is to be settled in cash.

(b) The trade balance is subject to the normal trade credit terms ranging from 30 to 60 (2020 - 30 to 60) days.

Included in the trade balance is an amount of RM4,446,549 (2020 – RM4,774,944) relating to the accrual of

purchases incurred during the financial year.

16. sHOrt-tErM inVEstMEnts

The Group and the Company invest in short-term money market which distributes income on monthly basis. The

income is exempted from corporate tax. The redemption proceeds for investments in short-term money market will

normally be collected by the next business day. Therefore, the Company considered the investments in short-term

money market represent investments in highly liquid money market instruments which are readily convertible to known

amounts of cash and are subject to an insignificant risk of changes in value.

The fair value of short-term money market investment is determined by reference to its quoted closing bid price at the

end of the reporting period.

Annual Report 2021 97