Page 44 - Handbook PG 20182019

P. 44

Faculty of Science Postgraduate Booklet, Session 2018/2019

References:

1. Bower, N.L., Gerber, H.U., Hickman, J.C., Jone, D.A. and Nesbitt C.J. (1977). Actuarial

nd

Mathematics. 2 Ed., The Society of Actuaries.

2. Klugman, S.A., H. H. Panjer, H.H. and Willmot, G.E. (2008). Loss Models: From Data to

Decisions. 3rd Ed., John Wiley & Sons.

3. Buhlmann, H. (1996). Mathematical Methods in Risk Theory. Springer, Germany.

4. Kellison, S.G., and London, R.L. (2011). Risk Models and Their Estimation. ACTEX.

5. Tse, Y. (2009). Nonlife Actuarial Models: Theory, Methods and Evaluation. Cambridge

University Press.

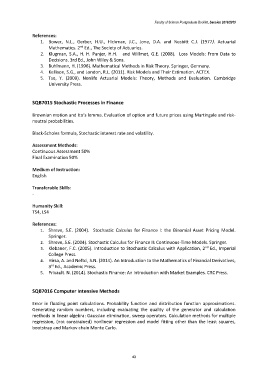

SQB7015 Stochastic Processes in Finance

Brownian motion and Ito’s lemma. Evaluation of option and future prices using Martingale and risk-

neutral probabilities.

Black-Scholes formula, Stochastic interest rate and volatility.

Assessment Methods:

Continuous Assessment 50%

Final Examination 50%

Medium of Instruction:

English

Transferable Skills:

-

Humanity Skill:

TS4, LS4

References:

1. Shreve, S.E. (2004). Stochastic Calculus for Finance I: the Binomial Asset Pricing Model.

Springer.

2. Shreve, S.E. (2004). Stochastic Calculus for Finance II: Continuous-Time Models. Springer.

nd

3. Klebaner, F.C. (2005). Introduction to Stochastic Calculus with Application, 2 Ed., Imperial

College Press.

4. Hirsa, A. and Neftci, S.N. (2014). An Introduction to the Mathematics of Financial Derivatives,

rd

3 Ed., Academic Press.

5. Privault. N. (2014). Stochastic Finance: An Introduction with Market Examples. CRC Press.

SQB7016 Computer Intensive Methods

Error in floating point calculations. Probability function and distribution function approximations.

Generating random numbers, including evaluating the quality of the generator and calculation

methods in linear algebra: Gaussian elimination, sweep operators. Calculation methods for multiple

regression, (not constrained) nonlinear regression and model fitting other than the least squares,

bootstrap and Markov chain Monte Carlo.

43