Page 87 - Annual Report 2021

P. 87

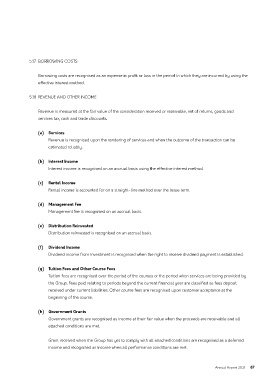

5.17 BORROWING COSTS

Borrowing costs are recognised as an expense in profit or loss in the period in which they are incurred by using the

effective interest method.

5.18 REVENUE AND OTHER INCOME

Revenue is measured at the fair value of the consideration received or receivable, net of returns, goods and

services tax, cash and trade discounts.

(a) services

Revenue is recognised upon the rendering of services and when the outcome of the transaction can be

estimated reliably.

(b) interest income

Interest income is recognised on an accrual basis using the effective interest method.

(c) rental income

Rental income is accounted for on a straight-line method over the lease term.

(d) Management Fee

Management fee is recognised on an accrual basis.

(e) Distribution reinvested

Distribution reinvested is recognised on an accrual basis.

(f) Dividend income

Dividend income from investment is recognised when the right to receive dividend payment is established.

(g) tuition Fees and Other course Fees

Tuition fees are recognised over the period of the courses or the period when services are being provided by

the Group. Fees paid relating to periods beyond the current financial year are classified as fees deposit

received under current liabilities. Other course fees are recognised upon customer acceptance at the

beginning of the course.

(h) government grants

Government grants are recognised as income at their fair value when the proceeds are receivable and all

attached conditions are met.

Grant received when the Group has yet to comply with all attached conditions are recognised as a deferred

income and recognised as income when all performance conditions are met.

Annual Report 2021 87