Page 86 - FBA UG PROGRAMME HANDBOOK 2017

P. 86

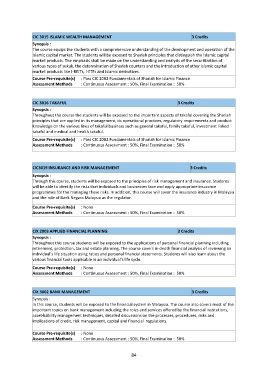

CIC 3015 ISLAMIC WEALTH MANAGEMENT 3 Credits

Synopsis :

The course equips the students with a comprehensive understanding of the development and operation of the

Islamic capital market. The students will be exposed to Shariah principles that distinguish the Islamic capital

market products. The emphasis shall be made on the understanding and analysis of the securitization of

various types of sukuk, the determination of Shariah counters and the introduction of other Islamic capital

market products like I-REITs, I-ETFs and Islamic derivatives.

Course Pre-requisite(s) : Pass CIC 2002 Fundamentals of Shariah for Islamic Finance

Assessment Methods : Continuous Assessment : 50%, Final Examination : 50%

CIC 3016 TAKAFUL 3 Credits

Synopsis :

Throughout the course the students will be exposed to the important aspects of takaful covering the Shariah

principles that are applied in its management, its operational practices, regulatory requirements and product

knowledge on the various lines of takaful business such as general takaful, family takaful, investment linked

takaful and medical and health takaful.

Course Pre-requisite(s) : Pass CIC 2002 Fundamentals of Shariah for Islamic Finance

Assessment Methods : Continuous Assessment : 50%, Final Examination : 50%

CIC3019 INSURANCE AND RISK MANAGEMENT 3 Credits

Synopsis :

Through this course, students will be exposed to the principles of risk management and insurance. Students

will be able to identify the risks that individuals and businesses face and apply appropriate insurance

programmes for the managing these risks. In addition, this course will cover the insurance industry in Malaysia

and the role of Bank Negara Malaysia as the regulator.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 50%, Final Examination : 50%

CIX 2003 APPLIED FINANCIAL PLANNING 3 Credits

Synopsis :

Throughout this course students will be exposed to the applications of personal financial planning including

retirement, protection, tax and estate planning. The course covers in-depth financial analysis of reviewing an

individual’s life situation using ratios and personal financial statements. Students will also learn about the

various financial tools applicable in an individual’s life cycle.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 50%, Final Examination : 50%

CIX 3002 BANK MANAGEMENT 3 Credits

Synopsis :

In this course, students will be exposed to the financial system in Malaysia. The course also covers most of the

important topics on bank management including the roles and services offered by the financial institutions,

asset-liability management techniques, detailed discussions on the processes, procedures, risks and

implications of credit, risk management, capital and financial regulations.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 50%, Final Examination : 50%

84