Page 81 - FBA UG PROGRAMME HANDBOOK 2017

P. 81

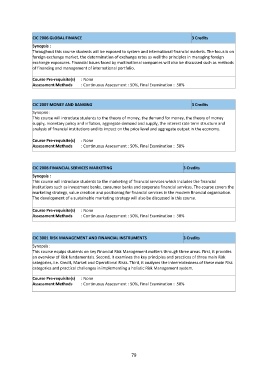

CIC 2006 GLOBAL FINANCE 3 Credits

Synopsis :

Throughout this course students will be exposed to system and international financial markets. The focus is on

foreign exchange market, the determination of exchange rates as well the principles in managing foreign

exchange exposures. Financial issues faced by multinational companies will also be discussed such as methods

of financing and management of international portfolio.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 50%, Final Examination : 50%

CIC 2007 MONEY AND BANKING 3 Credits

Synopsis :

This course will introduce students to the theory of money, the demand for money, the theory of money

supply, monetary policy and inflation, aggregate demand and supply, the interest rate term structure and

analysis of financial institutions and its impact on the price level and aggregate output in the economy.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 50%, Final Examination : 50%

CIC 2008 FINANCIAL SERVICES MARKETING 3 Credits

Synopsis :

This course will introduce students to the marketing of financial services which includes the financial

institutions such as investment banks, consumer banks and corporate financial services. The course covers the

marketing strategy, value creation and positioning for financial services in the modern financial organisation.

The development of a sustainable marketing strategy will also be discussed in this course.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 50%, Final Examination : 50%

CIC 3001 RISK MANAGEMENT AND FINANCIAL INSTRUMENTS 3 Credits

Synopsis :

This course equips students on key Financial Risk Management matters through three areas. First, it provides

an overview of Risk fundamentals. Second, it examines the key principles and practices of three main Risk

categories, i.e. Credit, Market and Operational Risks. Third, it analyses the interrelatedness of these main Risk

categories and practical challenges in implementing a holistic Risk Management system.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 50%, Final Examination : 50%

79