Page 65 - index

P. 65

◄Faculty of Economics and Administration►

Main Reference (1) McNeil D, Epidemiological Research Methods. Wiley,

1996.

(2) Hosmer D. W. and Lemeshow S, Applied Logistic

nd

Regression. Wiley, 2 Edition, 2000.

(3) Hosmer D. W. And Lemeshow S, Applied Survival

Analysis: Regression Modeling of Time to Event Data.

Wiley, 1999.

(4) Cox DR, Analysis of Binary Data. Chapman and Hall,

1994.

(5) Johnson RE and Johnson NL, Survival Models and

Data Analysis. Wiley, 1999.

th

(6) Rosner B, Fundamentals of Biostatistics. Duxbury, 5

Edition, 2000.

(7) Pagano M and Gauvreau K., Principles of Statistics.

nd

Duxbury, 2 Edition, 2000.

(8) Venables W. N. and Ripley B. D., Modern Applied

th

Statistics with S. Springer-Verlag New York, 4

Edition, 2002.

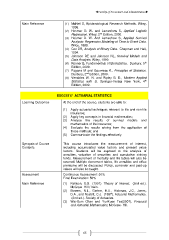

ESGC6317 ACTUARIAL STATISTICS

Learning Outcomes At the end of the course, students are able to:

(1) Apply actuarial techniques relevant to life and non-life

insurance;

(2) Apply key concepts in financial mathematics;

(3) Analyse the results of survival models and

mathematics of life insurance;

(4) Evaluate the results arising from the application of

these methods; and

(5) Communicate the findings effectively.

Synopsis of Course This course introduces the measurement of interest,

Contents including accumulated value factors and present value

factors. Students will be exposed to the analysis of

annuities, valuation of securities and cumulative sinking

funds. Measurement of mortality and life tables will also be

covered. Multiple-decrement tables, life annuities and office

premiums will be discussed. Policy, surrender and paid-up

values will also be taught.

Assessment Continuous Assessment: 50%

Final Examination: 50%

Main Reference (1) Kellison, S.G. (1991). Theory of Interest. (2nd ed.).

McGraw- Hill / Irwin.

(2) Bowers, N.L., Gerber, H.U., Hickman, J.C., Jones,

D.A., and Nesbitt, C.J. (1997). Actuarial Mathematics.

(2nd ed.). Society of Actuaries.

(3) Wai-Sum Chan and Yiu-Kuen Tse(2007), Financial

and Actuarial Mathematics, McGraw- Hill.

65