Page 48 - ASEAN-EU Dialogue 2018: Regional and Inter-Regional Economic Cooperation: Identifying Priorities for ASEAN and the EU

P. 48

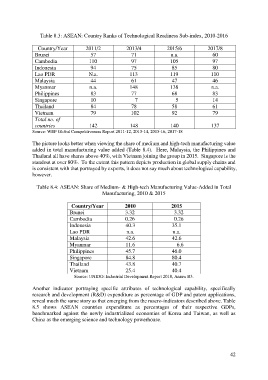

Table 8.3: ASEAN: Country Ranks of Technological Readiness Sub-index, 2010-2016

Country/Year 2011/2 2013/4 2015/6 2017/8

Brunei 57 71 n.a. 60

Cambodia 110 97 105 97

Indonesia 94 75 85 80

Lao PDR N.a. 113 119 110

Malaysia 44 61 47 46

Myanmar n.a. 148 138 n.a.

Philippines 83 77 68 83

Singapore 10 7 5 14

Thailand 84 78 58 61

Vietnam 79 102 92 79

Total no. of

countries 142 148 140 137

Source: WEF Global Competitiveness Report 2011-12, 2013-14, 2015-16, 2017-18

The picture looks better when viewing the share of medium and high-tech manufacturing value

added in total manufacturing value added (Table 8.4). Here, Malaysia, the Philippines and

Thailand all have shares above 40%, with Vietnam joining the group in 2015. Singapore is the

standout at over 80%. To the extent this pattern depicts production in global supply chains and

is consistent with that portrayed by exports, it does not say much about technological capability,

however.

Table 8.4: ASEAN: Share of Medium- & High-tech Manufacturing Value-Added in Total

Manufacturing, 2010 & 2015

Country/Year 2010 2015

Brunei 3.32 3.32

Cambodia 0.26 0.26

Indonesia 40.3 35.1

Lao PDR n.a. n.a.

Malaysia 42.6 42.6

Myanmar 11.6 6.6

Philippines 45.7 46.0

Singapore 84.8 80.4

Thailand 43.8 40.7

Vietnam 25.4 40.4

Source: UNIDO: Industrial Development Report 2018, Annex B3.

Another indicator portraying specific attributes of technological capability, specifically

research and development (R&D) expenditure as percentage of GDP and patent applications,

reveal much the same story as that emerging from the macro-indicators described above. Table

8.5 shows ASEAN countries expenditure as percentages of their respective GDPs,

benchmarked against the newly industrialized economies of Korea and Taiwan, as well as

China as the emerging science and technology powerhouse.

42