Page 77 - ASEAN-EU Dialogue 2018: Regional and Inter-Regional Economic Cooperation: Identifying Priorities for ASEAN and the EU

P. 77

12

10

8

6

4

2

0

1980 1985 1990 1995 2000 2005 2010 2015

GERMANY THAILAND

Source: World Bank (2018)

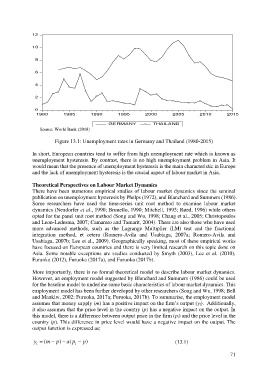

Figure 13.1: Unemployment rates in Germany and Thailand (1980-2015)

In short, European countries tend to suffer from high unemployment rate which is known as

unemployment hysteresis. By contrast, there is no high unemployment problem in Asia. It

would mean that the presence of unemployment hysteresis is the main characteristic in Europe

and the lack of unemployment hysteresis is the crucial aspect of labour market in Asia.

Theoretical Perspectives on Labour Market Dynamics

There have been numerous empirical studies of labour market dynamics since the seminal

publication on unemployment hysteresis by Phelps (1972), and Blanchard and Summers (1986).

Some researchers have used the time-series unit root method to examine labour market

dynamics (Neudorfer et al., 1990; Brunello, 1990; Mitchell, 1993; Røed, 1996) while others

opted for the panel unit root method (Song and Wu, 1998; Chang et al., 2005; Christopoulos

and Leon-Ledesma, 2007; Camarero and Tamarit, 2004). There are also those who have used

more advanced methods, such as the Lagrange Multiplier (LM) test and the fractional

integration method, et cetera (Romero-Avila and Usabiaga, 2007a; Romero-Avila and

Usabiaga, 2007b; Lee et al., 2009). Geographically speaking, most of these empirical works

have focused on European countries and there is very limited research on this topic done on

Asia. Some notable exceptions are studies conducted by Smyth (2003), Lee et al. (2010),

Furuoka (2012), Furuoka (2017a), and Furuoka (2017b).

More importantly, there is no formal theoretical model to describe labour market dynamics.

However, an employment model suggested by Blanchard and Summers (1986) could be used

for the baseline model to underline some basic characteristics of labour market dynamics. This

employment model has been further developed by other researchers (Song and Wu, 1998; Bell

and Mankiw, 2002; Furuoka, 2017a; Furuoka, 2017b). To summarise, the employment model

assumes that money supply (m) has a positive impact on the firm’s output (yi). Additionally,

it also assumes that the price level in the country (p) has a negative impact on the output. In

this model, there is a difference between output price in the firm (pi) and the price level in the

country (p). This difference in price level would have a negative impact on the output. The

output function is expressed as;

y (m p ) a (p ) p (13.1)

i

i

71