Page 41 - BAcc_Handbook_2024_2025

P. 41

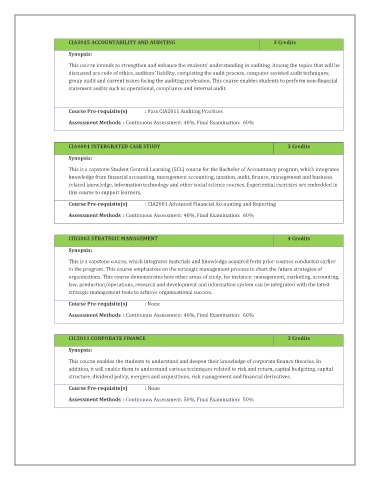

CIA3015 ACCOUNTABILITY AND AUDITING 3 Credits

Synopsis:

This course intends to strengthen and enhance the students’ understanding in auditing. Among the topics that will be

discussed are code of ethics, auditors’ liability, completing the audit process, computer assisted audit techniques,

group audit and current issues facing the auditing profession. This course enables students to perform non-financial

statement audits such as operational, compliance and internal audit.

Course Pre-requisite(s) : Pass CIA2011 Auditing Practices

Assessment Methods : Continuous Assessment: 40%, Final Examination: 60%

CIA4001 INTERGRATED CASE STUDY 3 Credits

Synopsis:

This is a capstone Student Centred Learning (SCL) course for the Bachelor of Accountancy program, which integrates

knowledge from financial accounting, management accounting, taxation, audit, finance, management and business

related knowledge, information technology and other social science courses. Experiential exercises are embedded in

this course to support learners.

Course Pre-requisite(s) : CIA2001 Advanced Financial Accounting and Reporting

Assessment Methods : Continuous Assessment: 40%, Final Examination: 60%

CIB3002 STRATEGIC MANAGEMENT 4 Credits

Synopsis:

This is a capstone course, which integrates materials and knowledge acquired form prior courses conducted earlier

in the program. This course emphasizes on the strategic management process to chart the future strategies of

organizations. This course demonstrates how other areas of study, for instance: management, marketing, accounting,

law, production/operations, research and development and information system can be integrated with the latest

strategic management tools to achieve organizational success.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment: 40%, Final Examination: 60%

CIC2011 CORPORATE FINANCE 3 Credits

Synopsis:

This course enables the students to understand and deepen their knowledge of corporate finance theories. In

addition, it will enable them to understand various techniques related to risk and return, capital budgeting, capital

structure, dividend policy, mergers and acquisitions, risk management and financial derivatives.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment: 50%, Final Examination: 50%