Page 43 - BAcc_Handbook_2024_2025

P. 43

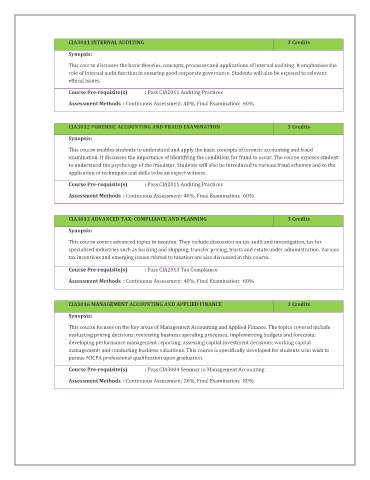

CIA3011 INTERNAL AUDITING 3 Credits

Synopsis:

This course discusses the basic theories, concepts, processes and applications of internal auditing. It emphasises the

role of internal audit function in ensuring good corporate governance. Students will also be exposed to relevant

ethical issues.

Course Pre-requisite(s) : Pass CIA2011 Auditing Practices

Assessment Methods : Continuous Assessment: 40%, Final Examination: 60%

CIA3012 FORENSIC ACCOUNTING AND FRAUD EXAMINATION 3 Credits

Synopsis:

This course enables students to understand and apply the basic concepts of forensic accounting and fraud

examination. It discusses the importance of identifying the conditions for fraud to occur. The course exposes student

to understand the psychology of the fraudster. Students will also be introduced to various fraud schemes and to the

application of techniques and skills to be an expert witness.

Course Pre-requisite(s) : Pass CIA2011 Auditing Practices

Assessment Methods : Continuous Assessment: 40%, Final Examination: 60%

CIA3013 ADVANCED TAX: COMPLIANCE AND PLANNING 3 Credits

Synopsis:

This course covers advanced topics in taxation. They include discussion on tax audit and investigation, tax for

specialised industries such as banking and shipping, transfer pricing, trusts and estate under administration. Various

tax incentives and emerging issues related to taxation are also discussed in this course.

Course Pre-requisite(s) : Pass CIA2013 Tax Compliance

Assessment Methods : Continuous Assessment: 40%, Final Examination: 60%

CIA3016 MANAGEMENT ACCOUNTING AND APPLIED FINANCE 3 Credits

Synopsis:

This course focuses on the key areas of Management Accounting and Applied Finance. The topics covered include

evaluating pricing decisions; reviewing business spending processes; implementing budgets and forecasts;

developing performance management reporting; assessing capital investment decisions; working capital

management; and conducting business valuations. This course is specifically developed for students who wish to

pursue MICPA professional qualification upon graduation.

Course Pre-requisite(s) : Pass CIA3004 Seminar in Management Accounting

Assessment Methods : Continuous Assessment: 20%, Final Examination: 80%