Page 126 - Buku_Panduan_Program_SME_Versi BI_Sesi_20172018

P. 126

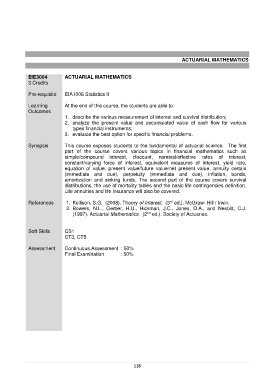

ACTUARIAL MATHEMATICS

EIE3004 ACTUARIAL MATHEMATICS

3 Credits

Pre-requisite EIA1006 Statistics II

Learning At the end of this course, the students are able to:

Outcomes

1. describe the various measurement of interest and survival distribution;

2. analyze the present value and accumulated value of cash flow for various

types financial instruments;

3. evaluate the best option for specific financial problems.

Synopsis This course exposes students to the fundamental of actuarial science. The first

part of the course covers various topics in financial mathematics such as

simple/compound interest, discount, nominal/effective rates of interest,

constant/varying force of interest, equivalent measures of interest, yield rate,

equation of value, present value/future value/net present value, annuity certain

(immediate and due), perpetuity (immediate and due), inflation, bonds,

amortization and sinking funds. The second part of the course covers survival

distributions, the use of mortality tables and the basic life contingencies definition.

Life annuities and life insurance will also be covered.

References 1. Kellison, S.G. (2008). Theory of Interest. (3 ed.). McGraw- Hill / Irwin.

rd

2. Bowers, N.L., Gerber, H.U., Hickman, J.C., Jones, D.A., and Nesbitt, C.J.

(1997). Actuarial Mathematics. (2 ed.). Society of Actuaries.

nd

Soft Skills CS1

CT3, CT5

Assessment Continuous Assessment : 50%

Final Examination : 50%

118