Page 128 - Buku_Panduan_Program_SME_Versi BI_Sesi_20172018

P. 128

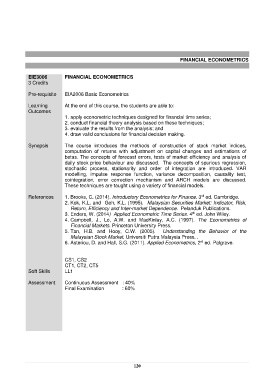

FINANCIAL ECONOMETRICS

EIE3006 FINANCIAL ECONOMETRICS

3 Credits

Pre-requisite EIA2006 Basic Econometrics

Learning At the end of this course, the students are able to:

Outcomes

1. apply econometric techniques designed for financial time series;

2. conduct financial theory analysis based on these techniques;

3. evaluate the results from the analysis; and

4. draw valid conclusions for financial decision making.

Synopsis The course introduces the methods of construction of stock market indices,

computation of returns with adjustment on capital changes and estimations of

betas. The concepts of forecast errors, tests of market efficiency and analysis of

daily stock price behaviour are discussed. The concepts of spurious regression,

stochastic process, stationarity and order of integration are introduced. VAR

modelling, impulse response function, variance decomposition, causality test,

cointegration, error correction mechanism and ARCH models are discussed.

These techniques are taught using a variety of financial models.

References 1. Brooks, C. (2014). Introductory Econometrics for Finance. 3 ed. Cambridge.

rd

2. Kok, K.L. and Goh, K.L. (1995). Malaysian Securities Market: Indicator, Risk,

Return, Efficiency and Inter-market Dependence. Pelanduk Publications.

3. Enders, W. (2014) Applied Econometric Time Series. 4 ed. John Wiley.

th

4. Campbell, J., Lo, A.W. and MacKinlay, A.C. (1997). The Econometrics of

Financial Markets. Princeton University Press.

5. Tan, H.B. and Hooy, C.W. (2005). Understanding the Behavior of the

Malaysian Stock Market. Universiti Putra Malaysia Press. .

rd

6. Asteriou, D. and Hall, S.G. (2011). Applied Econometrics, 2 ed. Palgrave.

CS1, CS2

CT1, CT2, CT5

Soft Skills LL1

Assessment Continuous Assessment : 40%

Final Examination : 60%

120