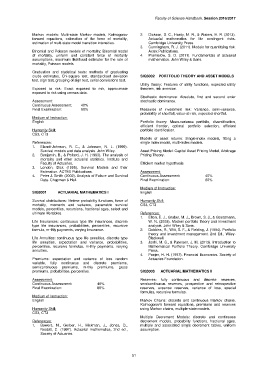

Page 55 - handbook 20162017

P. 55

Faculty of Science Handbook, Session 2016/2017

Markov models: Multi-state Markov models, Kolmogorov 2. Dickson, D. C., Hardy, M. R., & Waters, H. R. (2013).

forward equations, estimation of the force of mortality, Actuarial mathematics for life contingent risks.

estimation of multi-state model transition intensities. Cambridge University Press.

3. Cunningham, R. J. (2011). Models for quantifying risk.

Binomial and Poisson models of mortality: Binomial model Actex Publications.

of mortality, uniform and constant force of mortality 4. Promislow, S. D. (2011). Fundamentals of actuarial

assumptions, maximum likelihood estimator for the rate of mathematics. John Wiley & Sons.

mortality, Poisson models.

Graduation and statistical tests: methods of graduating

crude estimates, Chi-square test, standardised deviation SIQ3002 PORTFOLIO THEORY AND ASSET MODELS

test, sign test, grouping of sign test, serial correlations test.

Utility theory: Features of utility functions, expected utility

Exposed to risk: Exact exposed to risk, approximate theorem, risk aversion.

exposed to risk using census data.

Stochastic dominance: Absolute, first and second order

Assessment: stochastic dominance.

Continuous Assessment: 40%

Final Examination: 60% Measures of investment risk: Variance, semi-variance,

probability of shortfall, value-at-risk, expected shortfall.

Medium of Instruction:

English Portfolio theory: Mean-variance portfolio, diversification,

efficient frontier, optimal portfolio selection, efficient

Humanity Skill: portfolio identification.

CS3, CT3

Models of asset returns: Single-index models, fitting a

References: single index model, multi-index models.

1. Elandt-Johnson, R. C., & Johnson, N. L. (1999).

Survival models and data analysis. John Wiley. Asset Pricing Model: Capital Asset Pricing Model, Arbitrage

2. Benjamin, B., & Pollard, J. H. (1993). The analysis of Pricing Theory.

mortality and other actuarial statistics. Institute and

Faculty of Actuaries. Efficient market hypothesis

3. London, Dick (1998). Survival Models and their

Estimation. ACTEX Publications. Assessment:

4. Peter J. Smith (2002). Analysis of Failure and Survival Continuous Assessment: 40%

Data. Chapman & Hall. Final Examination: 60%

Medium of Instruction:

SIQ3001 ACTUARIAL MATHEMATICS I English

Survival distributions: lifetime probability functions, force of Humanity Skill:

mortality, moments and variance, parametric survival CS3, CT3

models, percentiles, recursions, fractional ages, select and

ultimate life tables. References:

1. Elton, E. J., Gruber, M. J., Brown, S. J., & Goetzmann,

Life Insurances: continuous type life insurances, discrete W. N. (2009). Modern portfolio theory and investment

type life insurances, probabilities, percentiles, recursive analysis. John Wiley & Sons.

formula, m-thly payments, varying insurance. 2. Dobbins, R., Witt, S. F., & Fielding, J. (1994). Portfolio

theory and investment management. 2nd Ed., Wiley-

Life Annuities: continuous type life annuities, discrete type Blackwell.

life annuities, expectation and variance, probabilities, 3. Joshi, M. S., & Paterson, J. M. (2013). Introduction to

percentiles, recursive formulas, m-thly payments, varying Mathematical Portfolio Theory. Cambridge University

annuities. Press.

4. Panjer, H. H. (1997). Financial Economics. Society of

Premiums: expectation and variance of loss random Actuaries Foundation.

variable, fully continuous and discrete premiums,

semicontinuous premiums, m-thly premiums, gross

premiums, probabilities, percentiles. SIQ3003 ACTUARIAL MATHEMATICS II

Assessment: Reserves: fully continuous and discrete reserves,

Continuous Assessment: 40% semicontinuous reserves, prospective and retrospective

Final Examination: 60% reserves, expense reserves, variance of loss, special

formulas, recursive formulas.

Medium of Instruction:

English Markov Chains: discrete and continuous Markov chains,

Kolmogorov’s forward equations, premiums and reserves

Humanity Skill: using Markov chains, multiple-state models.

CS3, CT3

Multiple Decrement Models: discrete and continuous

References: decrement models, probability functions, fractional ages,

1. Bowers, N., Gerber, H., Hickman, J., Jones, D., multiple and associated single decrement tables, uniform

Nesbitt, C. (1997). Actuarial mathematics, 2nd ed., assumption.

Society of Actuaries.

51