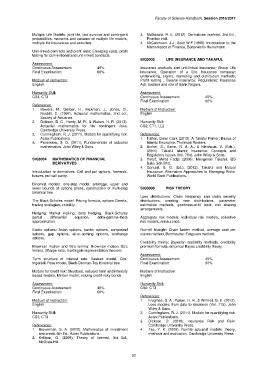

Page 56 - handbook 20162017

P. 56

Faculty of Science Handbook, Session 2016/2017

Multiple Life Models: joint life, last survivor and contingent 3. McDonald, R. L. (2012). Derivatives markets, 3rd Ed.,

probabilities, moments and variance of multiple life models, Prentice Hall.

multiple life insurances and annuities. 4. McCutcheon, J.J., Scott W.F.(1989). Introduction to the

Mathematics of Finance, Butterworth-Heinemann.

Unit-linked contracts and profit tests: Emerging costs, profit

testing for conventional and unit-linked contracts.

SIQ3005 LIFE INSURANCE AND TAKAFUL

Assessment:

Continuous Assessment: 40% Insurance products and unit-linked insurance; Group Life

Final Examination: 60% insurance; Operation of a Life Insurance company:

underwriting, claims, marketing and distribution methods;

Medium of Instruction: Profit testing ; Takaful insurance; Regulations: Insurance

English Act, taxation and role of Bank Negara.

Humanity Skill: Assessment:

CS3, CT3 Continuous Assessment: 40%

Final Examination: 60%

References:

1. Bowers, N., Gerber, H., Hickman, J., Jones, D., Medium of Instruction:

Nesbitt, C. (1997). Actuarial mathematics, 2nd ed., English

Society of Actuaries.

2. Dickson, D. C., Hardy, M. R., & Waters, H. R. (2013). Humanity Skill:

Actuarial mathematics for life contingent risks. CS2, CT1, LL2

Cambridge University Press.

3. Cunningham, R. J. (2011). Models for quantifying risk. References:

Actex Publications. 1. Fisher, Omar Clark (2013). A Takaful Primer: Basics of

4. Promislow, S. D. (2011). Fundamentals of actuarial Islamic Insurance. Thomson Reuters.

mathematics. John Wiley & Sons. 2. Archer, S., Karim, R. A. A., & Nienhaus, V. (Eds.).

(2011). Takaful Islamic Insurance: Concepts and

Regulatory Issues (Vol. 764). John Wiley & Sons.

SIQ3004 MATHEMATICS OF FINANCIAL 3. Yusof, Mohd Fadzli (2006). Mengenali Takaful, IBS

DERIVATIVES Buku Sdn Bhd.

4. Gonulal, S. O. (Ed.). (2012). Takaful and Mutual

Introduction to derivatives: Call and put options, forwards, Insurance: Alternative Approaches to Managing Risks.

futures, put-call parity. World Bank Publications.

Binomial models: one-step model, arbitrage, upper and

lower bounds of options prices, construction of multi-step SIQ3006 RISK THEORY

binomial tree.

Loss distributions: Claim frequency and claim severity

The Black-Scholes model: Pricing formula, options Greeks, distributions, creating new distributions, parameter

trading strategies, volatility. estimation methods, goodness-of-fit tests, risk sharing

arrangements.

Hedging: Market making, delta hedging, Black-Scholes

partial differential equation, delta-gamma-theta Aggregate risk models: Individual risk models, collective

approximation risk models, reinsurance.

Exotic options: Asian options, barrier options, compound Run-off triangle: Chain ladder method, average cost per

options, gap options, all-or-nothing options, exchange claims method, Bornheutter-Ferguson method.

options.

Credibility theory: Bayesian credibility methods, credibility

Brownian motion and Itô’s lemma: Brownian motion, Itô’s premium formula, empirical Bayes credibility theory.

lemma, Sharpe ratio, martingale representation theorem

Assessment:

Term structure of interest rate: Vasicek model, Cox- Continuous Assessment: 40%

Ingersoll-Ross model, Black-Derman-Toy binomial tree Final Examination: 60%

Models for credit risk: Structural, reduced form and intensity Medium of Instruction:

based models, Merton model, valuing credit risky bonds English

Assessment: Humanity Skill:

Continuous Assessment: 40% CS2, CT3

Final Examination: 60%

References:

Medium of Instruction: 1. Klugman, S. A., Panjer, H. H., & Willmot, G. E. (2012).

English Loss models: from data to decisions (Vol. 715). John

Wiley & Sons.

Humanity Skill: 2. Cunningham, R. J. (2011). Models for quantifying risk.

CS3, CT3 Actex Publications.

3. Dickson, D. (2010). Insurance Risk and Ruin.

References: Cambridge University Press.

1. Broverman, S. A. (2010). Mathematics of investment 4. Tse, Y. K. (2009). Nonlife actuarial models: theory,

and credit, 5th Ed., Actex Publications. methods and evaluation. Cambridge University Press.

2. Kellison, G. (2008). Theory of Interest, 3rd Ed.,

McGraw-Hill.

52