Page 54 - tmp

P. 54

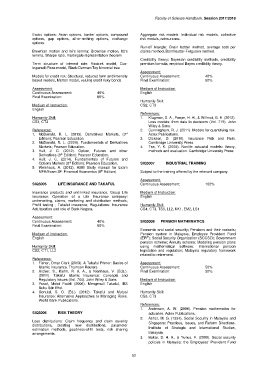

Faculty of Science Handbook, Session 2017/2018

Exotic options: Asian options, barrier options, compound Aggregate risk models: Individual risk models, collective

options, gap options, all-or-nothing options, exchange risk models, reinsurance.

options.

Run-off triangle: Chain ladder method, average cost per

Brownian motion and Itô’s lemma: Brownian motion, Itô’s claims method, Bornheutter-Ferguson method.

lemma, Sharpe ratio, martingale representation theorem

Credibility theory: Bayesian credibility methods, credibility

Term structure of interest rate: Vasicek model, Cox- premium formula, empirical Bayes credibility theory.

Ingersoll-Ross model, Black-Derman-Toy binomial tree

Assessment:

Models for credit risk: Structural, reduced form and intensity Continuous Assessment: 40%

based models, Merton model, valuing credit risky bonds Final Examination: 60%

Assessment: Medium of Instruction:

Continuous Assessment: 40% English

Final Examination: 60%

Humanity Skill:

Medium of Instruction: CS2, CT3

English

References:

Humanity Skill: 1. Klugman, S. A., Panjer, H. H., & Willmot, G. E. (2012).

CS3, CT3 Loss models: from data to decisions (Vol. 715). John

Wiley & Sons.

References: 2. Cunningham, R. J. (2011). Models for quantifying risk.

1. McDonald, R. L. (2013). Derivatives Markets, (3 rd Actex Publications.

Edition); Pearson Education. 3. Dickson, D. (2010). Insurance Risk and Ruin.

2. McDonald, R. L. (2009). Fundamentals of Derivatives Cambridge University Press.

Markets; Pearson Education. 4. Tse, Y. K. (2009). Nonlife actuarial models: theory,

3. Hull, J. C. (2012). Option, Futures and other methods and evaluation. Cambridge University Press.

th

Derivatives (8 Edition): Pearson Education.

4. Hull, J. C. (2014). Fundamentals of Futures and

th

Options Markets (8 Edition); Pearson Education. SIQ3007 INDUSTRIAL TRAINING

5. Weishaus, A. (2012). ASM Study manual for Exam

th

MFE/Exam 3F: Financial Economics (8 Edition). Subject to the training offered by the relevant company.

Assessment:

SIQ3005 LIFE INSURANCE AND TAKAFUL Continuous Assessment: 100%

Insurance products and unit-linked insurance; Group Life Medium of Instruction:

insurance; Operation of a Life Insurance company: English

underwriting, claims, marketing and distribution methods;

Profit testing ; Takaful insurance; Regulations: Insurance Humanity Skill:

Act, taxation and role of Bank Negara. CS4, CT3, TS3, LL2, KK1, EM2, LS1

Assessment:

Continuous Assessment: 40% SIQ3008 PENSION MATHEMATICS

Final Examination: 60%

Economic and social security; Pensions and their variants;

Medium of Instruction: Pension system in Malaysia; Employee Provident Fund

English (EPF); Social Security Organization (SOCSO); Government

pension scheme; Annuity scheme; Modeling pension plans

Humanity Skill: using mathematical software; International pension

CS2, CT1, LL2 legislation and regulation; Malaysia regulatory framework

related to retirement.

References:

1. Fisher, Omar Clark (2013). A Takaful Primer: Basics of Assessment:

Islamic Insurance. Thomson Reuters. Continuous Assessment: 50%

2. Archer, S., Karim, R. A. A., & Nienhaus, V. (Eds.). Final Examination: 50%

(2011). Takaful Islamic Insurance: Concepts and

Regulatory Issues (Vol. 764). John Wiley & Sons. Medium of Instruction:

3. Yusof, Mohd Fadzli (2006). Mengenali Takaful, IBS English

Buku Sdn Bhd.

4. Gonulal, S. O. (Ed.). (2012). Takaful and Mutual Humanity Skill:

Insurance: Alternative Approaches to Managing Risks. CS3, CT3

World Bank Publications.

References:

1. Anderson, A. W. (2006). Pension mathematics for

SIQ3006 RISK THEORY actuaries. Actex Publications.

2. Asher, M. G. (1994). Social Security in Malaysia and

Loss distributions: Claim frequency and claim severity Singapore: Practices, Issues, and Reform Directions.

distributions, creating new distributions, parameter

estimation methods, goodness-of-fit tests, risk sharing Institute of Strategic and International Studies,

arrangements. Malaysia.

3. Bakar, S. H. A., & Yunus, F. (2000). Social security

policies in Malaysia: the Employees’ Provident Fund

52