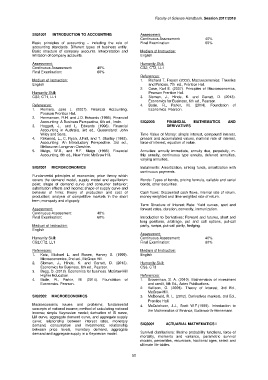

Page 52 - tmp

P. 52

Faculty of Science Handbook, Session 2017/2018

SIQ1001 INTRODUCTION TO ACCOUNTING Assessment:

Continuous Assessment: 40%

Basic principles of accounting – including the role of Final Examination: 60%

accounting standards. Different types of business entity.

Basic structure of company accounts. Interpretation and Medium of Instruction:

limitation of company accounts. English

Assessment: Humanity Skill:

Continuous Assessment: 40% CS2, CT2, LL1

Final Examination: 60%

References:

Medium of Instruction: 1. Richard T. Froyen (2002). Macroeconomics: Theories

English and Policies, 7th ed., Prentice Hall.

2. Case, Karl E. (2007). Principles of Macroeconomics,

Humanity Skill: Pearson Prentice Hall.

CS2, CT1, LL1 3. Sloman, J., Hinde, K. and Garratt, D. (2013).

Economics for Business, 6th ed., Pearson.

References: 4. Bade, R., Parkin, M. (2014). Foundation of

1. Reimers, Jane L. (2007). Financial Accounting, Economics. Pearson.

Pearson Prentice Hall.

2. Hermanson, R.H. and J.D. Edwards (1995). Financial

Accounting: A Business Perspective, 6th ed., Irwin. SIQ2003 FINANCIAL MATHEMATICS AND

3. Hoggett, J., and L. Edwards (1996). Financial DERIVATIVES

Accounting in Australia, 3rd ed., Queensland: John

Wiley and Sons. Time Value of Money: simple interest, compound interest,

4. Kirkwood, L., C. Ryan, J.Falt, and T. Stanley (1993). present and accumulated values, nominal rate of interest,

Accounting: An Introductory Perspective. 3rd ed., force of interest, equation of value.

Melbourne: Longman Cheshire.

5. Meigs, W.B., and R.F. Meigs (1995). Financial Annuities: annuity immediate, annuity due, perpetuity, m-

Accounting. 8th ed., New York: McGraw Hill. thly annuity, continuous type annuity, deferred annuities,

varying annuities.

SIQ2001 MICROECONOMICS Instalments: Amortization, sinking funds, amortization with

continuous payments.

Fundamental principles of economics; price theory which

covers the demand model, supply model and equilibrium Bonds: Types of bonds, pricing formula, callable and serial

point; shape of demand curve and consumer behavior; bonds, other securities.

substitution effects and income; shape of supply curve and

behavior of firms; theory of production and cost of Cash flows: Discounted cash flows, internal rate of return,

production; analysis of competitive markets in the short money-weighted and time weighted rate of return.

term; monopoly and oligopoly.

Term Structure of Interest Rate: Yield curves, spot and

Assessment: forward rates, duration, convexity, immunization.

Continuous Assessment: 40%

Final Examination: 60% Introduction to Derivatives: Forward and futures, short and

long positions, arbitrage, put and call options, put-call

Medium of Instruction: parity, swaps, put-call parity, hedging.

English

Assessment:

Humanity Skill: Continuous Assessment: 40%

CS2,CT2, LL1 Final Examination: 60%

References: Medium of Instruction:

1. Katz, Michael L. and Rosen, Harvey S. (1999). English

Microeconomics, 2nd ed., McGraw Hill.

2. Sloman, J., Hinde, K. and Garratt, D. (2013). Humanity Skill:

Economics for Business, 6th ed., Pearson. CS3, CT3

3. Begg, D. (2012). Economics for business. McGraw Hill

Higher Education. References:

4. Bade, R., Parkin, M. (2014). Foundation of 1. Broverman, S. A. (2010). Mathematics of investment

Economics. Pearson. and credit, 5th Ed., Actex Publications.

2. Kellison, G. (2008). Theory of Interest, 3rd Ed.,

McGraw-Hill.

SIQ2002 MACROECONOMICS 3. McDonald, R. L. (2012). Derivatives markets, 3rd Ed.,

Prentice Hall.

Macroeconomic issues and problems; fundamental 4. McCutcheon, J.J., Scott W.F.(1989). Introduction to

concepts of national income; method of calculating national the Mathematics of Finance, Butterworth-Heinemann.

income; simple Keynesian model; derivation of IS curve,

LM curve, aggregate demand curve, and aggregate supply

curve; relationship between interest rates, monetary

demand, consumption and investments; relationship SIQ3001 ACTUARIAL MATHEMATICS I

between price levels, monetary demand, aggregate

demand and aggregate supply in a Keynesian model. Survival distributions: lifetime probability functions, force of

mortality, moments and variance, parametric survival

models, percentiles, recursions, fractional ages, select and

ultimate life tables.

50