Page 107 - Annual Report 2021

P. 107

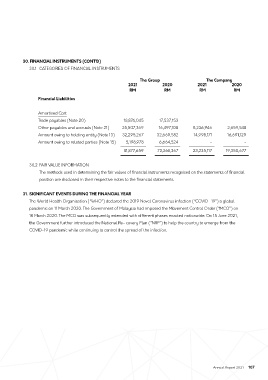

30. Financial instruMEnts (cOnt’D)

30.1 CATEGORIES OF FINANCIAL INSTRUMENTS

the group the company

2021 2020 2021 2020

rM rM rM rM

Financial liabilities

Amortised Cost

Trade payables (Note 20) 18,876,045 17,537,153 - -

Other payables and accruals (Note 21) 25,507,369 16,497,108 8,236,946 2,659,548

Amount owing to holding entity (Note 13) 32,295,267 32,669,582 14,998,171 16,691,129

Amount owing to related parties (Note 15) 5,198,978 6,664,524 - -

81,877,659 73,368,367 23,235,117 19,350,677

30.2 FAIR VALUE INFORMATION

The methods used in determining the fair values of financial instruments recognised on the statements of financial

position are disclosed in their respective notes to the financial statements.

31. signiFicant EVEnts During tHE Financial YEar

The World Health Organisation (“WHO”) declared the 2019 Novel Coronavirus infection (“COVID- 19”) a global

pandemic on 11 March 2020. The Government of Malaysia had imposed the Movement Control Order (“MCO”) on

18 March 2020. The MCO was subsequently extended with different phases enacted nationwide. On 15 June 2021,

the Government further introduced the National Re- covery Plan (“NRP”) to help the country to emerge from the

COVID-19 pandemic while continuing to control the spread of the infection.

Annual Report 2021 107