Page 102 - Annual Report 2021

P. 102

Overview Leadership Message Business Segment Moving Forward Our Resources Working for a Corporate Financial

Review Plan Better Tomorrow Governance statements

nOTES TO THE FInanCIaL STaTEmEnTS

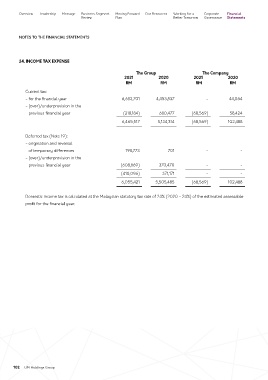

24. incOME tax ExPEnsE

the group the company

2021 2020 2021 2020

rM rM rM rM

Current tax:

- for the financial year 6,683,701 4,453,837 - 44,064

- (over)/underprovision in the

previous financial year (218,184) 680,477 (68,569) 58,424

6,465,517 5,134,314 (68,569) 102,488

Deferred tax (Note 19):

- origination and reversal

of temporary differences 198,773 701 - -

- (over)/underprovision in the

previous financial year (608,869) 370,470 - -

(410,096) 371,171 - -

6,055,421 5,505,485 (68,569) 102,488

Domestic income tax is calculated at the Malaysian statutory tax rate of 24% (2020 - 24%) of the estimated assessable

profit for the financial year.

102 UM Holdings Group