Page 103 - Annual Report 2021

P. 103

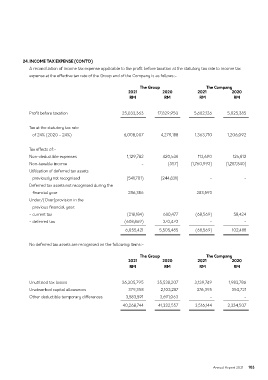

24. incOME tax ExPEnsE (cOnt’D)

A reconciliation of income tax expense applicable to the profit before taxation at the statutory tax rate to income tax

expense at the effective tax rate of the Group and of the Company is as follows:-

the group the company

2021 2020 2021 2020

rM rM rM rM

Profit before taxation 25,033,363 17,829,950 5,682,126 5,025,385

Tax at the statutory tax rate

of 24% (2020 - 24%) 6,008,007 4,279,188 1,363,710 1,206,092

Tax effects of:-

Non-deductible expenses 1,129,782 420,538 113,690 125,812

Non-taxable income - (357) (1,760,993) (1,287,840)

Utilisation of deferred tax assets

previously not recognised (541,701) (244,831) - -

Deferred tax assets not recognised during the

financial year 286,386 - 283,593 -

Under/(Over)provision in the

previous financial year:

- current tax (218,184) 680,477 (68,569) 58,424

- deferred tax (608,869) 370,470 - -

6,055,421 5,505,485 (68,569) 102,488

No deferred tax assets are recognised on the following items:-

the group the company

2021 2020 2021 2020

rM rM rM rM

Unutilised tax losses 36,305,795 35,538,207 3,139,749 1,983,786

Unabsorbed capital allowances 379,358 2,103,287 376,395 350,721

Other deductible temporary differences 3,583,591 3,691,063 - -

40,268,744 41,332,557 3,516,144 2,334,507

Annual Report 2021 103