Page 72 - Handbook Bachelor Degree of Science Academic Session 20212022

P. 72

Faculty of Science Handbook, Academic Session 2021/2022

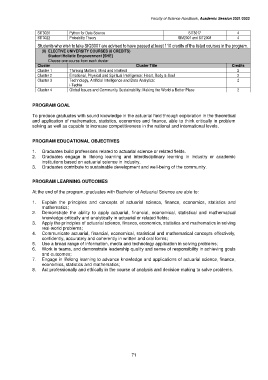

SIT3020 Python for Data Science SIT3017 4

SIT3022 Probability Theory SIM2001 and SIT2008 4

Students who wish to take SIQ3007 are advised to have passed at least 110 credits of the listed courses in the program.

(II) ELECTIVE UNIVERSITY COURSES (8 CREDITS)

Student Holistic Empowerment [SHE]

Choose one course from each cluster

Cluster Cluster Title Credits

Cluster 1 Thinking Matters: Mind and Intellect 2

Cluster 2 Emotional, Physical and Spiritual Intelligence: Heart, Body & Soul 2

Cluster 3 Technology, Artificial Intelligence and Data Analytics: 2

i-Techie

Cluster 4 Global Issues and Community Sustainability: Making the World a Better Place 2

PROGRAM GOAL

To produce graduates with sound knowledge in the actuarial field through exploration in the theoretical

and application of mathematics, statistics, economics and finance, able to think critically in problem

solving as well as capable to increase competitiveness in the national and international levels.

PROGRAM EDUCATIONAL OBJECTIVES

1. Graduates build professions related to actuarial science or related fields.

2. Graduates engage in lifelong learning and interdisciplinary learning in industry or academic

institutions based on actuarial science in industry.

3. Graduates contribute to sustainable development and well-being of the community.

PROGRAM LEARNING OUTCOMES

At the end of the program, graduates with Bachelor of Actuarial Science are able to:

1. Explain the principles and concepts of actuarial science, finance, economics, statistics and

mathematics;

2. Demonstrate the ability to apply actuarial, financial, economical, statistical and mathematical

knowledge critically and analytically in actuarial or related fields;

3. Apply the principles of actuarial science, finance, economics, statistics and mathematics in solving

real-world problems;

4. Communicate actuarial, financial, economical, statistical and mathematical concepts effectively,

confidently, accurately and coherently in written and oral forms;

5. Use a broad range of information, media and technology application in solving problems;

6. Work in teams, and demonstrate leadership quality and sense of responsibility in achieving goals

and outcomes;

7. Engage in lifelong learning to advance knowledge and applications of actuarial science, finance,

economics, statistics and mathematics;

8. Act professionally and ethically in the course of analysis and decision-making to solve problems.

71