Page 26 - Annual Report 2021

P. 26

Overview Leadership Message Business segment Moving Forward Our Resources Working for a Corporate Financial

review Plan Better Tomorrow Governance Statements

BuSInESS rEvIEw

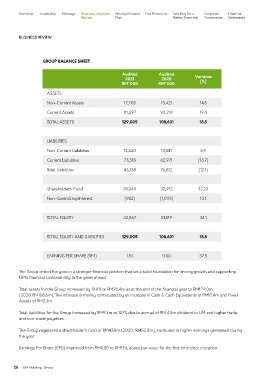

grOuP BalancE sHEEt

audited audited

2021 2020 Variance

rM’ 000 rM’ 000 (%)

ASSETS

Non-Current Assets 17,708 15,421 14.8

Current Assets 111,297 93,210 19.4

TOTAL ASSETS 129,005 108,631 18.8

LIABILITIES

Non-Current Liabilities 12,620 13,841 8.9

Current Liabilities 73,518 62,971 (16.7)

Total Liabilities 86,138 76,812 (12.1)

Shareholders’ Fund 43,849 32,912 33.23

Non-Controlling Interest (982) (1,093) 10.1

TOTAL EQUITY 42,867 31,819 34.1

TOTAL EQUITY AND LIABILITIES 129,005 108,631 18.8

EARNING PER SHARE (RM) 1.10 0.80 37.5

The Group ended the year in a stronger financial position that set a solid foundation for driving growth and supporting

UM’s financial sustainability in the years ahead.

Total assets for the Group increased by 18.8% or RM20.4m as at the end of the financial year to RM129.0m

(2020:RM108.6m). The increase is mainly contributed by an increase in Cash & Cash Equivalents of RM17.4m and Fixed

Assets of RM2.3m.

Total liabilities for the Group increased by RM9.3m or 12.1% due to accrual of RM 4.5m dividend to UM and higher trade

and non-trade payables.

The Group registered a shareholder’s fund of RM43.8m (2020: RM32.9m), attributed to higher earnings generated during

the year.

Earnings Per Share (EPS) improved from RM0.80 to RM1.10, above par value for the first time since inception.

26 UM Holdings Group