Page 25 - Annual Report 2021

P. 25

Business Review

Amidst the volatility and uncertainty presented by the COVID-19 pandemic and its attendant risks, the Group recorded an

improved financial performance for the year under review.

Overall, the Group achieved marked increases across the key financial indicators of profits, assets and cashflows.

The improved performance can be attributed to better performance by healthcare, education and plantation divisions.

Going forward, the Group intends to optimise the performance of other subsidiaries to diversify revenue streams while

better managing our financial risks.

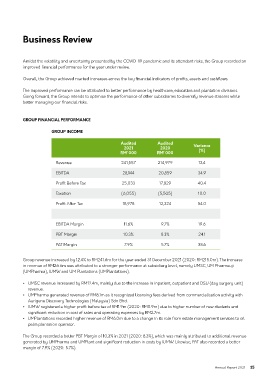

grOuP Financial PErFOrMancE

grOuP incOME

audited audited

2021 2020 Variance

rM’ 000 rM’ 000 (%)

Revenue 241,557 214,979 12.4

EBITDA 28,144 20,859 34.9

Profit Before Tax 25,033 17,829 40.4

Taxation (6,055) (5,505) 10.0

Profit After Tax 18,978 12,324 54.0

EBITDA Margin 11.6% 9.7% 19.6

PBT Margin 10.3% 8.3% 24.1

PAT Margin 7.9% 5.7% 38.6

Group revenue increased by 12.4% to RM241.6m for the year ended 31 December 2021 (2020: RM215.0m). The increase

in revenue of RM26.6m was attributed to a stronger performance at subsidiary level, namely UMSC, UM Pharmauji

(UMPharma), IUMW and UM Plantations (UMPlantations).

• UMSC revenue increased by RM12.4m, mainly due to the increase in inpatient, outpatient and DSU (day surgery unit)

revenue.

• UMPharma generated revenue of RM8.1m as it recognized licensing fees derived from commercialisation activity with

Aurigene Discovery Technologies (Malaysia) Sdn Bhd.

• IUMW registered a higher profit before tax of RM1.9m (2020: RM0.9m) due to higher number of new students and

significant reduction in cost of sales and operating expenses by RM2.7m.

• UMPlantations recorded higher revenue of RM6.0m due to a change in its role from estate management services to oil

palm plantation operator.

The Group recorded a better PBT Margin of 10.3% in 2021 (2020: 8.3%), which was mainly attributed to additional revenue

generated by UMPharma and UMPlant and significant reduction in costs by IUMW. Likewise, PAT also recorded a better

margin of 7.9% (2020: 5.7%).

Annual Report 2021 25