Page 75 - Annual Report 2021

P. 75

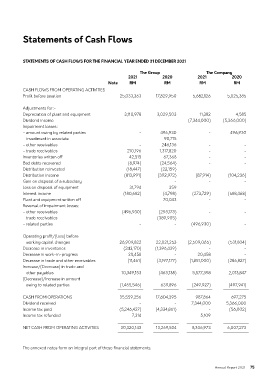

Statements of Cash Flows

statEMEnts OF casH FlOWs FOr tHE Financial YEar EnDED 31 DEcEMBEr 2021

the group the company

2021 2020 2021 2020

note rM rM rM rM

CASH FLOWS FROM OPERATING ACTIVITIES

Profit before taxation 25,033,363 17,829,950 5,682,126 5,025,385

Adjustments for:-

Depreciation of plant and equipment 3,110,978 3,029,503 11,382 4,585

Dividend income - (7,344,000) (5,366,000)

Impairment losses:

- amount owing by related parties - 496,930 - 496,930

- investment in associate - 90,715 - -

- other receivables - 246,136 - -

- trade receivables 210,196 1,317,820 - -

Inventories written off 42,515 67,368 - -

Bad debts recovered (8,974) (24,564) - -

Distribution reinvested (18,447) (22,159) - -

Distribution income (813,991) (392,972) (87,914) (104,236)

Gain on disposal of a subsidiary - - -

Loss on disposal of equipment 31,794 359 - -

Interest income (180,682) (4,798) (273,729) (588,468)

Plant and equipment written off 70,043 - -

Reversal of impairment losses:

- other receivables (496,930) (293,173) - -

- trade receivables - (389,905) - -

- related parties - - (496,930) -

Operating profit/(loss) before

working capital changes 26,909,822 22,021,253 (2,509,065) (531,804)

Decrease in inventories (243,170) (1,396,439) - -

Decrease in work-in-progress 20,458 - 20,458 -

Decrease in trade and other receivables (11,461) (3,197,177) (1,851,000) (286,827)

Increase/(Decrease) in trade and

other payables 10,349,153 (463,138) 5,577,398 2,013,847

(Decrease)/Increase in amount

owing to related parties (1,465,546) 639,896 (249,927) (497,941)

CASH FROM OPERATIONS 35,559,256 17,604,395 987,864 697,275

Dividend received - - 7,344,000 5,366,000

Income tax paid (5,246,427) (4,334,861) - (56,002)

Income tax refunded 7,314 - 5,109 -

NET CASH FROM OPERATING ACTIVITIES 30,320,143 13,269,534 8,336,973 6,007,273

The annexed notes form an integral part of these financial statements.

Annual Report 2021 75