Page 56 - FBA UG PROGRAMME HANDBOOK 2017

P. 56

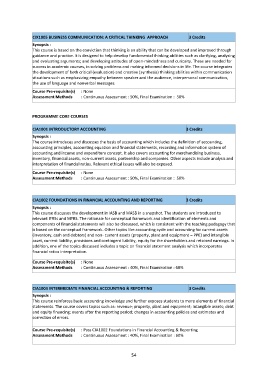

CIX1005 BUSINESS COMMUNICATION: A CRITICAL THINKING APPROACH 3 Credits

Synopsis :

This course is based on the conviction that thinking is an ability that can be developed and improved through

guidance and practice. It is designed to help develop fundamental thinking abilities such as clarifying, analysing

and evaluating arguments; and developing attitudes of open-mindedness and curiosity. These are needed for

success in academic courses, in solving problems and making informed decisions in life. The course integrates

the development of both critical (evaluation) and creative (synthesis) thinking abilities within communication

situations such as emphasizing empathy between speaker and the audience, interpersonal communication,

the use of language and nonverbal messages.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 50%, Final Examination : 50%

PROGRAMME CORE COURSES

CIA1001 INTRODUCTORY ACCOUNTING 3 Credits

Synopsis :

The course introduces and discusses the basis of accounting which includes the definition of accounting,

accounting principles, accounting equation and financial statements, recording and information system of

accounting and income and expenditure concept. It also covers accounting for merchandising business,

inventory, financial assets, non-current assets, partnership and companies. Other aspects include analysis and

interpretation of financial ratios. Relevant ethical issues will also be exposed.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 50%, Final Examination : 50%

CIA1002 FOUNDATIONS IN FINANCIAL ACCOUNTING AND REPORTING 3 Credits

Synopsis :

This course discusses the development in IASB and MASB in a snapshot. The students are introduced to

relevant IFRSs and MFRS. The rationale for conceptual framework and identification of elements and

components of financial statements will also be discussed, which is consistent with the teaching pedagogy that

is based on the conceptual framework. Other topics like accounting cycle and accounting for current assets

(inventory, cash and debtors) and non- current assets (property, plant and equipment – PPE) and intangible

asset, current liability, provisions and contingent liability, equity for the shareholders and retained earnings. In

addition, one of the topics discussed includes a topic on financial statement analysis which incorporates

financial ratios interpretation.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

CIA1003 INTERMEDIATE FINANCIAL ACCOUNTING & REPORTING 3 Credits

Synopsis :

This course reinforces basic accounting knowledge and further exposes students to more elements of financial

statements. The course covers topics such as: revenue; property, plant and equipment; intangible assets; debt

and equity financing; events after the reporting period; changes in accounting policies and estimates and

correction of errors.

Course Pre-requisite(s) : Pass CIA1002 Foundations in Financial Accounting & Reporting

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

54