Page 59 - FBA UG PROGRAMME HANDBOOK 2017

P. 59

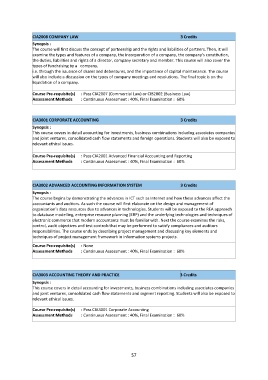

CIA2008 COMPANY LAW 3 Credits

Synopsis :

The course will first discuss the concept of partnership and the rights and liabilities of partners. Then, it will

examine the types and features of a company, the incorporation of a company, the company’s constitution,

the duties, liabilities and rights of a director, company secretary and member. This course will also cover the

types of fundraising by a company,

i.e. through the issuance of shares and debentures, and the importance of capital maintenance. The course

will also include a discussion on the types of company meetings and resolutions. The final topic is on the

liquidation of a company.

Course Pre-requisite(s) : Pass CIA2007 (Commercial Law) or CIB2002 (Business Law)

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

CIA3001 CORPORATE ACCOUNTING 3 Credits

Synopsis :

This course covers in detail accounting for investments, business combinations including associates companies

and joint ventures, consolidated cash flow statements and foreign operations. Students will also be exposed to

relevant ethical issues.

Course Pre-requisite(s) : Pass CIA2001 Advanced Financial Accounting and Reporting

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

CIA3002 ADVANCED ACCOUNTING INFORMATION SYSTEM 3 Credits

Synopsis :

The course begins by demonstrating the advances in ICT such as Internet and how these advances affect the

accountants and auditors. As such the course will first elaborate on the design and management of

organization’s data resources due to advances in technologies. Students will be exposed to the REA approach

to database modelling, enterprise resource planning (ERP) and the underlying technologies and techniques of

electronic commerce that modern accountants must be familiar with. Next the course examines the risks,

control, audit objectives and test controls that may be performed to satisfy compliances and auditors

responsibilities. The course ends by describing project management and discussing key elements and

techniques of project management framework in information systems projects.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

CIA3003 ACCOUNTING THEORY AND PRACTICE 3 Credits

Synopsis :

This course covers in detail accounting for investments, business combinations including associates companies

and joint ventures, consolidated cash flow statements and segment reporting. Students will also be exposed to

relevant ethical issues.

Course Pre-requisite(s) : Pass CIA3001 Corporate Accounting

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

57