Page 60 - FBA UG PROGRAMME HANDBOOK 2017

P. 60

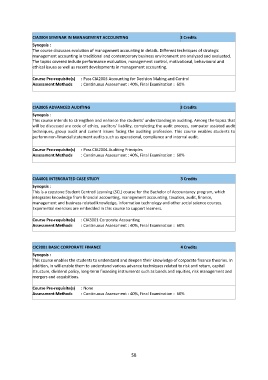

CIA3004 SEMINAR IN MANAGEMENT ACCOUNTING 3 Credits

Synopsis :

The course discusses evolution of management accounting in details. Different techniques of strategic

management accounting in traditional and contemporary business environment are analysed and evaluated.

The topics covered include performance evaluation, management control, motivational, behavioural and

ethical issues as well as recent developments in management accounting.

Course Pre-requisite(s) : Pass CIA2003 Accounting for Decision Making and Control

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

CIA3005 ADVANCED AUDITING 3 Credits

Synopsis :

This course intends to strengthen and enhance the students’ understanding in auditing. Among the topics that

will be discussed are code of ethics, auditors’ liability, completing the audit process, computer assisted audit

techniques, group audit and current issues facing the auditing profession. This course enables students to

perform non-financial statement audits such as operational, compliance and internal audit.

Course Pre-requisite(s) : Pass CIA2004 Auditing Principles

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

CIA4001 INTERGRATED CASE STUDY 3 Credits

Synopsis :

This is a capstone Student Centred Learning (SCL) course for the Bachelor of Accountancy program, which

integrates knowledge from financial accounting, management accounting, taxation, audit, finance,

management and business related knowledge, information technology and other social science courses.

Experiential exercises are embedded in this course to support learners.

Course Pre-requisite(s) : CIA3001 Corporate Accounting

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

CIC2001 BASIC CORPORATE FINANCE 4 Credits

Synopsis :

This course enables the students to understand and deepen their knowledge of corporate finance theories. In

addition, in will enable them to understand various advance techniques related to risk and return, capital

structure, dividend policy, long-term financing instruments such as bonds and equities, risk management and

mergers and acquisitions.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

58