Page 57 - FBA UG PROGRAMME HANDBOOK 2017

P. 57

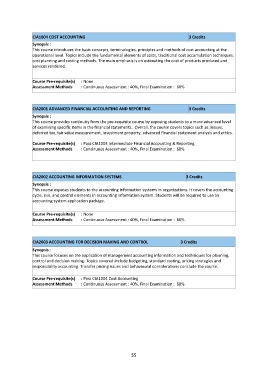

CIA1004 COST ACCOUNTING 3 Credits

Synopsis :

This course introduces the basic concepts, terminologies, principles and methods of cost accounting at the

operational level. Topics include the fundamental elements of costs, traditional cost accumulation techniques,

cost planning and costing methods. The main emphasis is on estimating the cost of products produced and

services rendered.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

CIA2001 ADVANCED FINANCIAL ACCOUNTING AND REPORTING 3 Credits

Synopsis :

This course provides continuity from the pre-requisite course by exposing students to a more advanced level

of examining specific items in the financial statements. Overall, the course covers topics such as: leases,

deferred tax, fair value measurement, investment property, advanced financial statement analysis and ethics.

Course Pre-requisite(s) : Pass CIA1003 Intermediate Financial Accounting & Reporting

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

CIA2002 ACCOUNTING INFORMATION SYSTEMS 3 Credits

Synopsis :

This course exposes students to the accounting information systems in organizations. It covers the accounting

cycle, risk, and control elements in accounting information system. Students will be required to use an

accounting system application package.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

CIA2003 ACCOUNTING FOR DECISION MAKING AND CONTROL 3 Credits

Synopsis :

This course focuses on the application of management accounting information and techniques for planning,

control and decision making. Topics covered include budgeting, standard costing, pricing strategies and

responsibility accounting. Transfer pricing issues and behavioural considerations conclude the course.

Course Pre-requisite(s) : Pass CIA1004 Cost Accounting

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

55