Page 29 - BFin_Handbook_2024_2025

P. 29

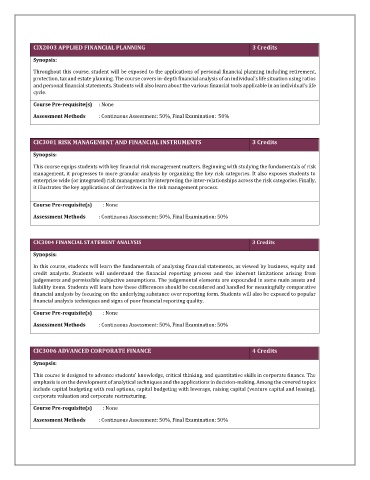

CIX2003 APPLIED FINANCIAL PLANNING 3 Credits

Synopsis:

Throughout this course, student will be exposed to the applications of personal financial planning including retirement,

protection, tax and estate planning. The course covers in-depth financial analysis of an individual’s life situation using ratios

and personal financial statements. Students will also learn about the various financial tools applicable in an individual’s life

cycle.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment: 50%, Final Examination: 50%

CIC3001 RISK MANAGEMENT AND FINANCIAL INSTRUMENTS 3 Credits

Synopsis:

This course equips students with key financial risk management matters. Beginning with studying the fundamentals of risk

management, it progresses to more granular analysis by organizing the key risk categories. It also exposes students to

enterprise wide (or integrated) risk management by interpreting the inter-relationships across the risk categories. Finally,

it illustrates the key applications of derivatives in the risk management process.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment: 50%, Final Examination: 50%

CIC3004 FINANCIAL STATEMENT ANALYSIS 3 Credits

Synopsis:

In this course, students will learn the fundamentals of analysing financial statements, as viewed by business, equity and

credit analysts. Students will understand the financial reporting process and the inherent limitations arising from

judgements and permissible subjective assumptions. The judgemental elements are expounded in some main assets and

liability items. Students will learn how these differences should be considered and handled for meaningfully comparative

financial analysis by focusing on the underlying substance over reporting form. Students will also be exposed to popular

financial analysis techniques and signs of poor financial reporting quality.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment: 50%, Final Examination: 50%

CIC3006 ADVANCED CORPORATE FINANCE 4 Credits

Synopsis:

This course is designed to advance students’ knowledge, critical thinking, and quantitative skills in corporate finance. The

emphasis is on the development of analytical techniques and the applications in decision-making. Among the covered topics

include capital budgeting with real options, capital budgeting with leverage, raising capital (venture capital and leasing),

corporate valuation and corporate restructuring.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment: 50%, Final Examination: 50%