Page 11 - MPA_MINI_HANDBOOK_S1_2425_FINAL

P. 11

◄Faculty of Business and Economics►

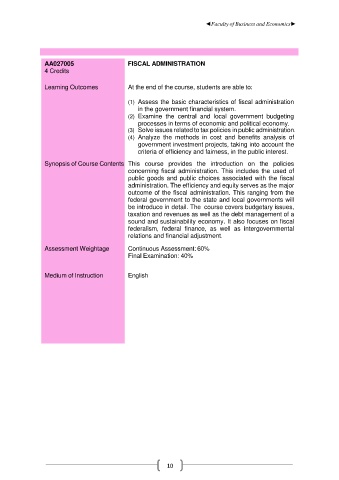

AA027005 FISCAL ADMINISTRATION

4 Credits

Learning Outcomes At the end of the course, students are able to:

(1) Assess the basic characteristics of fiscal administration

in the government financial system.

(2) Examine the central and local government budgeting

processes in terms of economic and political economy.

(3) Solve issues related to tax policies in public administration.

(4) Analyze the methods in cost and benefits analysis of

government investment projects, taking into account the

criteria of efficiency and fairness, in the public interest.

Synopsis of Course Contents This course provides the introduction on the policies

concerning fiscal administration. This includes the used of

public goods and public choices associated with the fiscal

administration. The efficiency and equity serves as the major

outcome of the fiscal administration. This ranging from the

federal government to the state and local governments will

be introduce in detail. The course covers budgetary issues,

taxation and revenues as well as the debt management of a

sound and sustainability economy. It also focuses on fiscal

federalism, federal finance, as well as intergovernmental

relations and financial adjustment.

Assessment Weightage Continuous Assessment: 60%

Final Examination: 40%

Medium of Instruction English

10