Page 26 - index

P. 26

◄Faculty of Economics and Administration►

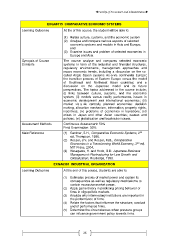

EXGA6115 COMPARATIVE ECONOMIC SYSTEMS

Learning Outcomes At the of this course, the student will be able to:

(1) Relate culture, customs, and the economic system

(2) Analyse and compare various aspects of selected

economic systems and models in Asia and Europe;

and

(3) Examine issues and problem of selected economies in

Europe and Asia

Synopsis of Course The course analyse and compares selected economic

Contents systems in term of the industrial and financial structures,

regulatory environments, management approaches and

macro-economic trends, including a discussion on the so-

called Anglo Saxon systems vis-a-vis continental Europe;

the transition process of Eastern Europe versus the model

of Southeast and Northeast Asian countries; and a

discussion on the Japanese model and its future

perspectives. The topics addressed in the course include;

(i) links between culture, customs, and the economic

system; (ii) models versus reality performance, issues in

economic development and international economics; (iii)

market vis-a-vis centrally planned economies: decision

making, allocation mechanism, information, property rights,

incentives; (iv) problems of economies in transitions; (v0

crises in Japan and other Asian countries; causes and

policies; (vi) globalisation and localisation issues.

Assessment Methods Continuous Assessment: 50%

Final Examination: 50%

nd

Main Reference (1) Gardner, S.H., Comparative Economic Systems, 2

ed, Thompson, 1998.

(2) Rosser, J.V. and Rosser, M.B., Comparative

nd

Economics in a Transforming World Economy, 2 ed,

MIT Press, 2004.

(3) Hasegawa, H. and Hook, G.D. Japanese Business

Management: Restructuring for Low Growth and

Globalization, Routledge, 1998.

EXGA6301 INDUSTRIAL ORGANIZATION

Learning Outcomes At the end of this course, students are able to:

(1) Estimates proxies of market power and explain its

consequences as well as regulatory mechanisms to

contain excessive market power.

(2) Apply game theory in predicting pricing behavior of

firms in oligopolistic markets.

(3) Analyze why intermediary institutions are important in

the performance of firms.

(4) Relate the factors that influence the structure, conduct

and of performance firms.

(5) Determine the circumstances when pressure groups

can influence government policy towards firms.

26