Page 88 - Buku_Panduan_Program_SME_Versi BI_Sesi_20172018

P. 88

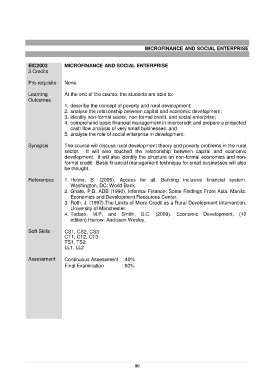

MICROFINANCE AND SOCIAL ENTERPRISE

EIC2003 MICROFINANCE AND SOCIAL ENTERPRISE

3 Credits

Pre-requisite None

Learning At the end of the course, the students are able to:

Outcomes

1. describe the concept of poverty and rural development;

2. analyse the relationship between capital and economic development;

3. identify non-formal sector, non-formal credit, and social enterprise;

4. comprehend basic financial management in microcredit and prepare a projected

cash flow analysis of very small businesses; and

5. analyse the role of social enterprise in development.

Synopsis The course will discuss rural development theory and poverty problems in the rural

sector. It will also touched the relationship between capital and economic

development. It will also identify the structure on non-formal economics and non-

formal credit. Basic financial management technique for small businesses will also

be thought.

References 1. Helms, B. (2006). Access for all. Building inclusive financial system.

Washington, DC: World Bank

2. Ghate, P.B. ADB (1990). Informal Finance: Some Findings From Asia. Manila:

Economics and Development Resources Center.

3. Roth. J. (1997).The Limits of Micro Credit as a Rural Development Intervention.

University of Manchester.

4. Todaro, M.P. and Smith, S.C. (2009). Economic Development, (10

edition).Harlow: Addisson Wesley.

Soft Skills CS1, CS2, CS3

CT1, CT2, CT3

TS1, TS2

LL1, LL2

Assessment Continuous Assessment : 40%

Final Examination : 60%

80