Page 35 - Master_of_Business_Administration_Handbook_20242025

P. 35

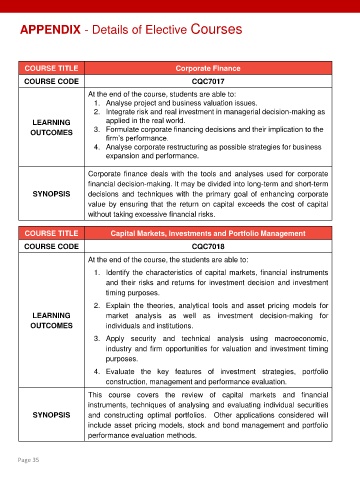

APPENDIX - Details of Elective Courses

COURSE TITLE Corporate Finance

COURSE CODE CQC7017

At the end of the course, students are able to:

1. Analyse project and business valuation issues.

2. Integrate risk and real investment in managerial decision-making as

LEARNING applied in the real world.

OUTCOMES 3. Formulate corporate financing decisions and their implication to the

firm’s performance.

4. Analyse corporate restructuring as possible strategies for business

expansion and performance.

Corporate finance deals with the tools and analyses used for corporate

financial decision-making. It may be divided into long-term and short-term

SYNOPSIS decisions and techniques with the primary goal of enhancing corporate

value by ensuring that the return on capital exceeds the cost of capital

without taking excessive financial risks.

COURSE TITLE Capital Markets, Investments and Portfolio Management

COURSE CODE CQC7018

At the end of the course, the students are able to:

1. Identify the characteristics of capital markets, financial instruments

and their risks and returns for investment decision and investment

timing purposes.

2. Explain the theories, analytical tools and asset pricing models for

LEARNING market analysis as well as investment decision-making for

OUTCOMES individuals and institutions.

3. Apply security and technical analysis using macroeconomic,

industry and firm opportunities for valuation and investment timing

purposes.

4. Evaluate the key features of investment strategies, portfolio

construction, management and performance evaluation.

This course covers the review of capital markets and financial

instruments, techniques of analysing and evaluating individual securities

SYNOPSIS and constructing optimal portfolios. Other applications considered will

include asset pricing models, stock and bond management and portfolio

performance evaluation methods.

Page 35