Page 36 - Master_of_Business_Administration_Handbook_20242025

P. 36

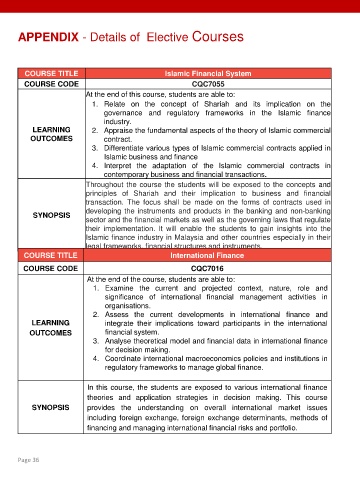

APPENDIX - Details of Elective Courses

COURSE TITLE Islamic Financial System

COURSE CODE CQC7055

At the end of this course, students are able to:

1. Relate on the concept of Shariah and its implication on the

governance and regulatory frameworks in the Islamic finance

industry.

LEARNING 2. Appraise the fundamental aspects of the theory of Islamic commercial

OUTCOMES contract.

3. Differentiate various types of Islamic commercial contracts applied in

Islamic business and finance

4. Interpret the adaptation of the Islamic commercial contracts in

contemporary business and financial transactions.

Throughout the course the students will be exposed to the concepts and

principles of Shariah and their implication to business and financial

transaction. The focus shall be made on the forms of contracts used in

developing the instruments and products in the banking and non-banking

SYNOPSIS

sector and the financial markets as well as the governing laws that regulate

their implementation. It will enable the students to gain insights into the

Islamic finance industry in Malaysia and other countries especially in their

legal frameworks, financial structures and instruments.

COURSE TITLE International Finance

COURSE CODE CQC7016

At the end of the course, students are able to:

1. Examine the current and projected context, nature, role and

significance of international financial management activities in

organisations.

2. Assess the current developments in international finance and

LEARNING integrate their implications toward participants in the international

OUTCOMES financial system.

3. Analyse theoretical model and financial data in international finance

for decision making.

4. Coordinate international macroeconomics policies and institutions in

regulatory frameworks to manage global finance.

In this course, the students are exposed to various international finance

theories and application strategies in decision making. This course

SYNOPSIS provides the understanding on overall international market issues

including foreign exchange, foreign exchange determinants, methods of

financing and managing international financial risks and portfolio.

Page 36