Page 60 - PROSPECTUS FEA IT 17-18

P. 60

◄Faculty of Economics and Administration►

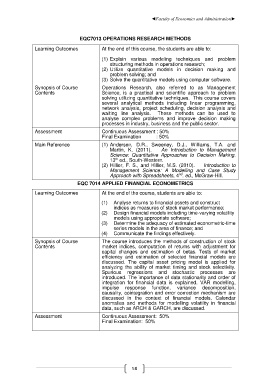

EQC7013 OPERATIONS RESEARCH METHODS

Learning Outcomes At the end of this course, the students are able to:

(1) Explain various modeling techniques and problem

structuring methods in operations research;

(2) Utilize quantitative models in decision making and

problem solving; and

(3) Solve the quantitative models using computer software.

Synopsis of Course Operations Research, also referred to as Management

Contents Science, is a practical and scientific approach to problem

solving utilizing quantitative techniques. This course covers

several analytical methods including linear programming,

network analysis, project scheduling, decision analysis and

waiting line analysis. These methods can be used to

analyse complex problems and improve decision making

processes in industry, business and the public sector.

Assessment Continuous Assessment : 50%

Final Examination : 50%

Main Reference (1) Andersen, D.R., Sweeney, D.J., Williams, T.A. and

Martin, K. (2011). An Introduction to Management

Science: Quantitative Approaches to Decision Making.

th

13 ed., South-Western.

(2) Hillier, F. S., and Hillier, M.S. (2010). Introduction to

Management Science: A Modelling and Case Study

nd

Approach with Spreadsheets, 4 . ed., McGraw-Hill.

EQC 7014 APPLIED FINANCIAL ECONOMETRICS

Learning Outcomes At the end of the course, students are able to:

(1) Analyse returns to financial assets and construct

indices as measures of stock market performance;

(2) Design financial models including time-varying volatility

models using appropriate software;

(3) Determine the adequacy of estimated econometric-time

series models in the area of finance; and

(4) Communicate the findings effectively.

Synopsis of Course The course introduces the methods of construction of stock

Contents market indices, computation of returns with adjustment for

capital changes and estimation of betas. Tests of market

efficiency and estimation of selected financial models are

discussed. The capital asset pricing model is applied for

analyzing the ability of market timing and stock selectivity.

Spurious regressions and stochastic processes are

introduced. The importance of data stationarity and order of

integration for financial data is explained. VAR modelling,

impulse response function, variance decomposition,

causality, cointegration and error correction mechanism are

discussed in the context of financial models. Calendar

anomalies and methods for modelling volatility in financial

data, such as ARCH & GARCH, are discussed.

Assessment Continuous Assessment: 50%

Final Examination: 50%

58