Page 72 - FBA UG PROGRAMME HANDBOOK 2017

P. 72

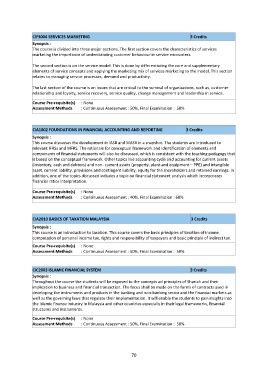

CIF3004 SERVICES MARKETING 3 Credits

Synopsis :

The course is divided into three major sections. The first section covers the characteristics of services

marketing the importance of understanding customer behaviour in service encounters.

The second section is on the service model. This is done by differentiating the core and supplementary

elements of service concepts and applying the marketing mix of services marketing to the model. This section

relates to managing service processes, demand and productivity.

The last section of the course is on issues that are critical to the survival of organisations, such as, customer

relationship and loyalty, service recovery, service quality, change management and leadership in service.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 50%, Final Examination : 50%

CIA1002 FOUNDATIONS IN FINANCIAL ACCOUNTING AND REPORTING 3 Credits

Synopsis :

This course discusses the development in IASB and MASB in a snapshot. The students are introduced to

relevant IFRSs and MFRS. The rationale for conceptual framework and identification of elements and

components of financial statements will also be discussed, which is consistent with the teaching pedagogy that

is based on the conceptual framework. Other topics like accounting cycle and accounting for current assets

(inventory, cash and debtors) and non- current assets (property, plant and equipment – PPE) and intangible

asset, current liability, provisions and contingent liability, equity for the shareholders and retained earnings. In

addition, one of the topics discussed includes a topic on financial statement analysis which incorporates

financial ratios interpretation.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 40%, Final Examination : 60%

CIA2010 BASICS OF TAXATION MALAYSIA 3 Credits

Synopsis :

This course is an introduction to taxation. This course covers the basic principles of taxation of income,

computation of personal income tax, rights and responsibility of taxpayers and basic principle of indirect tax.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 50%, Final Examination : 50%

CIC2003 ISLAMIC FINANCIAL SYSTEM 3 Credits

Synopsis :

Throughout the course the students will be exposed to the concepts ad principles of Shariah and their

implication to business and financial transaction. The focus shall be made on the forms of contracts used in

developing the instruments and products in the banking and non-banking sector and the financial markets as

well as the governing laws that regulate their implementation. It will enable the students to gain insights into

the Islamic finance industry in Malaysia and other countries especially in their legal frameworks, financial

structures and instruments.

Course Pre-requisite(s) : None

Assessment Methods : Continuous Assessment : 50%, Final Examination : 50%

70