Page 27 - PROSPECTUS FEA IT 17-18

P. 27

◄Faculty of Economics and Administration►

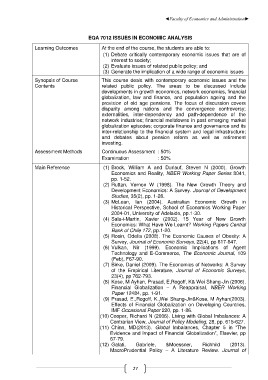

EQA 7012 ISSUES IN ECONOMIC ANALYSIS

Learning Outcomes At the end of the course, the students are able to:

(1) Debate critically contemporary economic issues that are of

interest to society;

(2) Evaluate issues of related public policy; and

(3) Generate the implication of a wide range of economic issues

Synopsis of Course This course deals with contemporary economic issues and the

Contents related public policy. The areas to be discussed include

developments in growth economics, network economics, financial

globalization, law and finance, and population ageing and the

provision of old age pensions. The focus of discussion covers

disparity among nations and the convergence controversy;

externalities, inter-dependency and path-dependence of the

network industries; financial meltdowns in past emerging market

globalization episodes; corporate finance and governance and its

inter-relationship to the financial system and legal infrastructure;

and debates about pension reform as well as retirement

investing.

Assessment Methods Continuous Assessment : 50%

Examination : 50%

Main Reference (1) Brock, William A and Durlauf, Steven N (2000). Growth

Economics and Reality, NBER Working Paper Series 8041,

pp. 1-52.

(2) Ruttan, Vernon W (1998). The New Growth Theory and

Development Economics: A Survey. Journal of Development

Studies, 35(2), pp. 1-26.

(3) McLean, Ian (2004). Australian Economic Growth in

Historical Perspective, School of Economics Working Paper

2004-01, University of Adelaide, pp.1-30.

(4) Sala-i-Martin, Xavier (2002). 15 Year of New Growth

Economics: What Have We Learnt? Working Papers Central

Bank of Chile 172, pp.1-20.

(5) Rosin, Odelia (2008). The Economic Causes of Obesity: A

Survey, Journal of Economic Surveys, 22(4), pp 617-647.

(6) Vulkan, Nir (1999). Economic Implications of Agent

Technology and E-Commerce, The Economic Journal, 109

(Feb), F67-90.

(7) Birke, Daniel (2009). The Economics of Networks: A Survey

of the Empirical Literature, Journal of Economic Surveys,

23(4), pp 762-793.

(8) Kose, M Ayhan, Prasad, E,Rogoff, K& Wei Shang-Jin (2006).

Financial Globalization – A Reappraisal, NBER Working

Paper 12484, pp. 1-91.

(9) Prasad, E.,Rogoff, K.,Wei Shang-Jin&Kose, M Ayhan(2003).

Effects of Financial Globalization on Developing Countries,

IMF Occasional Paper 220, pp. 1-86.

(10) Cooper, Richard N (2006). Living with Global Imbalances: A

Contrarian View, Journal of Policy Modeling, 28, pp. 615-627.

(11) Chinn, MD(2013). Global Imbalances, Chapter 5 in “The

Evidence and Impact of Financial Globalization”, Elsevier, pp

67-79.

(12) Galati, Gabriele, &Moessner, Richhild (2013).

MacroPrudential Policy – A Literature Review. Journal of

27