Page 24 - PROSPECTUS FEA IT 17-18

P. 24

◄Faculty of Economics and Administration►

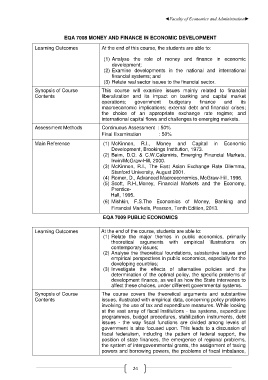

EQA 7008 MONEY AND FINANCE IN ECONOMIC DEVELOPMENT

Learning Outcomes At the end of this course, the students are able to:

(1) Analyse the role of money and finance in economic

development;

(2) Examine developments in the national and international

financial systems; and

(3) Relate real sector issues to the financial sector.

Synopsis of Course This course will examine issues mainly related to financial

Contents liberalization and its impact on banking and capital market

operations; government budgetary finance and its

macroeconomic implications; external debt and financial crises;

the choice of an appropriate exchange rate regime; and

international capital flows and challenges to emerging markets.

Assessment Methods Continuous Assessment : 50%

Final Examination : 50%

Main Reference (1) McKinnon, R.I., Money and Capital in Economic

Development, Brookings Institution, 1973.

(2) Beim, D.O. & C.W.Calomiris, Emerging Financial Markets,

Irwin/McGraw-Hill, 2000.

(3) McKinnon, R.I., The East Asian Exchange Rate Dilemma,

Stanford University, August 2001.

(4) Romer, D., Advanced Macroeconomics, McGraw-Hill, 1996.

(5) Scott, R.H.,Money, Financial Markets and the Economy,

Prentice-

Hall, 1995.

(6) Mishkin, F.S.The Economics of Money, Banking and

Financial Markets, Pearson, Tenth Edition, 2013.

EQA 7009 PUBLIC ECONOMICS

Learning Outcomes At the end of the course, students are able to:

(1) Relate the major themes in public economics, primarily

theoretical arguments with empirical illustrations on

contemporary issues;

(2) Analyse the theoretical foundations, substantive issues and

empirical perspectives in public economics, especially for the

developing countries;

(3) Investigate the effects of alternative policies and the

determination of the optimal policy, the specific problems of

development finance, as well as how the State intervenes to

affect these choices, under different governmental systems.

Synopsis of Course The course covers the theoretical arguments and substantive

Contents issues, illustrated with empirical data, concerning policy problems

involving the use of tax and expenditure measures. While looking

at the vast array of fiscal institutions - tax systems, expenditure

programmes, budget procedures, stabilization instruments, debt

issues - the way fiscal functions are divided among levels of

government is also focused upon. This leads to a discussion of

fiscal federalism, including the pattern of federal support, the

position of state finances, the emergence of regional problems,

the system of intergovernmental grants, the assignment of taxing

powers and borrowing powers, the problems of fiscal imbalance,

24