Page 166 - FINAL_HANDBOOK_20242025

P. 166

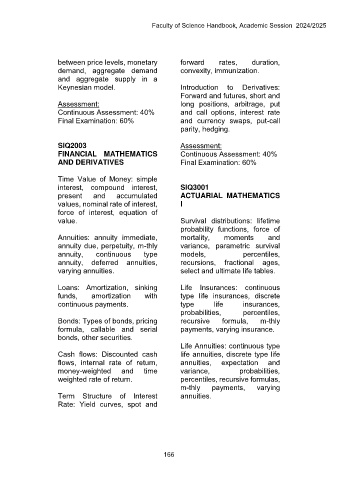

Faculty of Science Handbook, Academic Session 2024/2025

between price levels, monetary forward rates, duration,

demand, aggregate demand convexity, immunization.

and aggregate supply in a

Keynesian model. Introduction to Derivatives:

Forward and futures, short and

Assessment: long positions, arbitrage, put

Continuous Assessment: 40% and call options, interest rate

Final Examination: 60% and currency swaps, put-call

parity, hedging.

SIQ2003 Assessment:

FINANCIAL MATHEMATICS Continuous Assessment: 40%

AND DERIVATIVES Final Examination: 60%

Time Value of Money: simple

interest, compound interest, SIQ3001

present and accumulated ACTUARIAL MATHEMATICS

values, nominal rate of interest, I

force of interest, equation of

value. Survival distributions: lifetime

probability functions, force of

Annuities: annuity immediate, mortality, moments and

annuity due, perpetuity, m-thly variance, parametric survival

annuity, continuous type models, percentiles,

annuity, deferred annuities, recursions, fractional ages,

varying annuities. select and ultimate life tables.

Loans: Amortization, sinking Life Insurances: continuous

funds, amortization with type life insurances, discrete

continuous payments. type life insurances,

probabilities, percentiles,

Bonds: Types of bonds, pricing recursive formula, m-thly

formula, callable and serial payments, varying insurance.

bonds, other securities.

Life Annuities: continuous type

Cash flows: Discounted cash life annuities, discrete type life

flows, internal rate of return, annuities, expectation and

money-weighted and time variance, probabilities,

weighted rate of return. percentiles, recursive formulas,

m-thly payments, varying

Term Structure of Interest annuities.

Rate: Yield curves, spot and

166