Page 167 - FINAL_HANDBOOK_20242025

P. 167

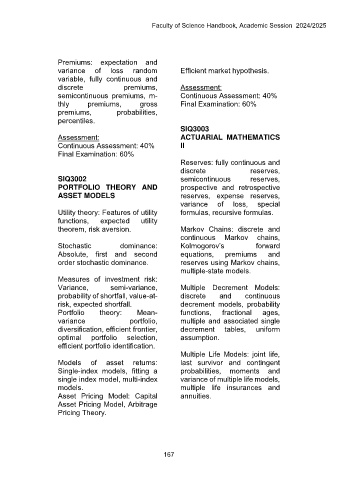

Faculty of Science Handbook, Academic Session 2024/2025

Premiums: expectation and

variance of loss random Efficient market hypothesis.

variable, fully continuous and

discrete premiums, Assessment:

semicontinuous premiums, m- Continuous Assessment: 40%

thly premiums, gross Final Examination: 60%

premiums, probabilities,

percentiles.

SIQ3003

Assessment: ACTUARIAL MATHEMATICS

Continuous Assessment: 40% II

Final Examination: 60%

Reserves: fully continuous and

discrete reserves,

SIQ3002 semicontinuous reserves,

PORTFOLIO THEORY AND prospective and retrospective

ASSET MODELS reserves, expense reserves,

variance of loss, special

Utility theory: Features of utility formulas, recursive formulas.

functions, expected utility

theorem, risk aversion. Markov Chains: discrete and

continuous Markov chains,

Stochastic dominance: Kolmogorov’s forward

Absolute, first and second equations, premiums and

order stochastic dominance. reserves using Markov chains,

multiple-state models.

Measures of investment risk:

Variance, semi-variance, Multiple Decrement Models:

probability of shortfall, value-at- discrete and continuous

risk, expected shortfall. decrement models, probability

Portfolio theory: Mean- functions, fractional ages,

variance portfolio, multiple and associated single

diversification, efficient frontier, decrement tables, uniform

optimal portfolio selection, assumption.

efficient portfolio identification.

Multiple Life Models: joint life,

Models of asset returns: last survivor and contingent

Single-index models, fitting a probabilities, moments and

single index model, multi-index variance of multiple life models,

models. multiple life insurances and

Asset Pricing Model: Capital annuities.

Asset Pricing Model, Arbitrage

Pricing Theory.

167