Page 85 - Handbook Bachelor Degree of Science Academic Session 20212022

P. 85

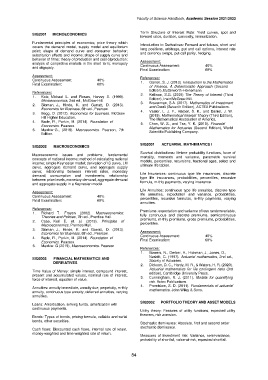

Faculty of Science Handbook, Academic Session 2021/2022

Term Structure of Interest Rate: Yield curves, spot and

SIQ2001 MICROECONOMICS

forward rates, duration, convexity, immunization.

Fundamental principles of economics; price theory which

covers the demand model, supply model and equilibrium Introduction to Derivatives: Forward and futures, short and

point; shape of demand curve and consumer behavior; long positions, arbitrage, put and call options, interest rate

and currency swaps, put-call parity, hedging.

substitution effects and income; shape of supply curve and

behavior of firms; theory of production and cost of production; Assessment:

analysis of competitive markets in the short term; monopoly

and oligopoly. Continuous Assessment: 40%

Final Examination: 60%

Assessment: References:

Continuous Assessment: 40%

Final Examination: 60% 1. Garrett, S. J. (2013). Introduction to the Mathematics

of Finance. A Deterministic Approach (Second

Edition), Butterworth-Heinemann.

References: 2. Kellison, S.G. (2009) The Theory of Interest (Third

1. Katz, Michael L. and Rosen, Harvey S. (1999). Edition), Irwin/McGraw-Hill.

Microeconomics, 2nd ed., McGraw Hill.

2. Sloman, J., Hinde, K. and Garratt, D. (2013). 3. Broverman, S.A. (2017). Mathematics of Investment

and Credit (Seventh Edition), ACTEX Publications.

Economics for Business, 6th ed., Pearson.

3. Begg, D. (2012). Economics for business. McGraw 4. Vaaler, L. J. F., Harper, S. K., and Daniel, J. W.

(2019). Mathematical Interest Theory (Third Edition),

Hill Higher Education. The Mathematical Association of America.

4. Bade, R., Parkin, M. (2014). Foundation of 5. Chan, W. S., and Tse, Y. K. (2018). Financial

Economics. Pearson.

5. Mankiw G., (2018). Macroecomics. Pearson, 7th Mathematics for Actuaries (Second Edition), World

Scientific Publishing Company.

Edition.

SIQ3001 ACTUARIAL MATHEMATICS I

SIQ2002 MACROECONOMICS

Survival distributions: lifetime probability functions, force of

Macroeconomic issues and problems; fundamental mortality, moments and variance, parametric survival

concepts of national income; method of calculating national models, percentiles, recursions, fractional ages, select and

income; simple Keynesian model; derivation of IS curve, LM ultimate life tables.

curve, aggregate demand curve, and aggregate supply

curve; relationship between interest rates, monetary

demand, consumption and investments; relationship Life Insurances: continuous type life insurances, discrete

type life insurances, probabilities, percentiles, recursive

between price levels, monetary demand, aggregate demand formula, m-thly payments, varying insurance.

and aggregate supply in a Keynesian model.

Life Annuities: continuous type life annuities, discrete type

Assessment:

Continuous Assessment: 40% life annuities, expectation and variance, probabilities,

percentiles, recursive formulas, m-thly payments, varying

Final Examination: 60%

annuities.

References:

1. Richard T. Froyen (2002). Macroeconomics: Premiums: expectation and variance of loss random variable,

Theories and Policies, 7th ed., Prentice Hall. fully continuous and discrete premiums, semicontinuous

2. Case, Karl E. et. al. (2013). Principles of premiums, m-thly premiums, gross premiums, probabilities,

percentiles.

Macroeconomics, Prentice Hall.

3. Sloman, J., Hinde, K. and Garratt, D. (2013).

Economics for Business, 6th ed., Pearson. Assessment:

4. Bade, R., Parkin, M. (2014). Foundation of Continuous Assessment: 40%

Final Examination:

60%

Economics. Pearson.

5. Mankiw. G (2019), Macroeconomics. Pearson

References:

1. Bowers, N., Gerber, H., Hickman, J., Jones, D.,

SIQ2003 FINANCIAL MATHEMATICS AND Nesbitt, C. (1997). Actuarial mathematics, 2nd ed.,

DERIVATIVES Society of Actuaries.

2. Dickson, D. C., Hardy, M. R., & Waters, H. R. (2020).

Actuarial mathematics for life contingent risks (3rd

Time Value of Money: simple interest, compound interest,

present and accumulated values, nominal rate of interest, edition). Cambridge University Press.

force of interest, equation of value. 3. Cunningham, R. J. (2011). Models for quantifying

risk. Actex Publications.

4. Promislow, S. D. (2011). Fundamentals of actuarial

Annuities: annuity immediate, annuity due, perpetuity, m-thly

annuity, continuous type annuity, deferred annuities, varying mathematics. John Wiley & Sons.

annuities.

SIQ3002 PORTFOLIO THEORY AND ASSET MODELS

Loans: Amortization, sinking funds, amortization with

continuous payments.

Utility theory: Features of utility functions, expected utility

theorem, risk aversion.

Bonds: Types of bonds, pricing formula, callable and serial

bonds, other securities.

Stochastic dominance: Absolute, first and second order

stochastic dominance.

Cash flows: Discounted cash flows, internal rate of return,

money-weighted and time weighted rate of return.

Measures of investment risk: Variance, semi-variance,

probability of shortfall, value-at-risk, expected shortfall.

84