Page 87 - Handbook Bachelor Degree of Science Academic Session 20212022

P. 87

Faculty of Science Handbook, Academic Session 2021/2022

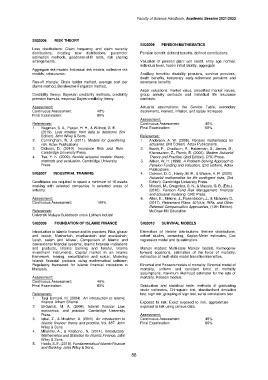

SIQ3006 RISK THEORY

SIQ3009 PENSION MATHEMATICS

Loss distributions: Claim frequency and claim severity

distributions, creating new distributions, parameter Pension benefit: defined benefits, defined contributions

estimation methods, goodness-of-fit tests, risk sharing

arrangements. Valuation of pension plan: unit credit, entry age normal,

individual level, frozen initial liability, aggregate

Aggregate risk models: Individual risk models, collective risk

models, reinsurance. Ancillary benefits: disability pensions, survivor pensions,

death benefits, temporary early-retirement pensions and

Run-off triangle: Chain ladder method, average cost per severance benefits

claims method, Bornheutter-Ferguson method.

Asset valuations: market value, smoothed market values,

Credibility theory: Bayesian credibility methods, credibility group annuity contracts and individual life insurance

premium formula, empirical Bayes credibility theory. contracts.

Assessment: Actuarial assumptions: the Service Table, secondary

Continuous Assessment: 40% decrements, interest, inflation, and salary Increases.

Final Examination: 60%

Assessment:

References: Continuous Assessment: 40%

1. Klugman, S. A., Panjer, H. H., & Willmot, G. E. Final Examination: 60%

(2019). Loss models: from data to decisions (5th

Edition). John Wiley & Sons. References:

2. Cunningham, R. J. (2011). Models for quantifying 1. Anderson, A. W. (2006). Pension mathematics for

risk. Actex Publications actuaries, (3rd Edition). Actex Publications.

3. Dickson, D. (2010). Insurance Risk and Ruin. 2. Booth, P., Chadburn, R., Haberman, S., James, D.,

Cambridge University Press Khorasanee, Z., Plumb, R. (2005). Modern Actuarial

4. Tse, Y. K. (2009). Nonlife actuarial models: theory, Theory and Practice, (2nd Edition). CRC Press.

methods and evaluation. Cambridge University 3. Aitken, W. H. (1996), A Problem-Solving Approach to

Press. Pension Funding and Valuation, (2nd Edition). Actex

Publications.

SIQ3007 INDUSTRIAL TRAINING 4. Dickson, D. C., Hardy, M. R., & Waters, H. R. (2020).

Actuarial mathematics for life contingent risks, (3rd

Candidates are required to spend a minimum of 16 weeks Edtion). Cambridge University Press.

working with selected companies in selected areas of 5. Micocci, M., Gregoriou, G. N., & Masala, G. B. (Eds.).

industry. (2010). Pension Fund Risk Management: financial

and actuarial modeling. CRC Press.

Assessment: 6. Allen, E., Melone, J., Rasenbloom, J., & Mahoney D.

Continuous Assessment: 100% (2017). Retirement Plans: 401(k)s, IRAs, and Other

Deferred Compensation Approaches, (12th Edition).

References: McGraw-Hill Education.

Universiti Malaya Guidebook untuk Latihan Industri

SIQ3008 FOUNDATION OF ISLAMIC FINANCE SIQ3010 SURVIVAL MODELS

Introduction to Islamic finance and its practices; Riba, gharar Estimation of lifetime distributions: lifetime distributions,

and maisir; Musharkah, mudharabah and murabahah; cohort studies, censoring, Kaplan-Meier estimates, Cox

Ijarah, salam and istisna’; Çomparison of Islamic and regression model and its estimation.

conventional financial systems; Islamic financial institutions

and products, Islamic banking and takaful, Islamic Markov models: Multi-state Markov models, Kolmogorov

investment instruments; Capital market in an Islamic forward equations, estimation of the force of mortality,

framework, leasing, securitization and sukuk; Modeling estimation of multi-state model transition intensities.

Islamic financial products using mathematical software;

Regulatory framework for Islamic financial institutions in Binomial and Poisson models of mortality: Binomial model of

Malaysia. mortality, uniform and constant force of mortality

assumptions, maximum likelihood estimator for the rate of

Assessment: mortality, Poisson models.

Continuous Assessment: 40%

Final Examination: 60% Graduation and statistical tests: methods of graduating

crude estimates, Chi-square test, standardised deviation

References: test, sign test, grouping of sign test, serial correlations test.

1. Taqi Usmani, M. (2004). An introduction to Islamic

finance. Arham Shamsi. Exposed to risk: Exact exposed to risk, approximate

2. El-Gamal, M. A. (2006). Islamic finance: Law, exposed to risk using census data.

economics, and practice. Cambridge University

Press. Assessment:

3. Iqbal, Z., & Mirakhor, A. (2011). An introduction to Continuous Assessment: 40%

Islamic finance: theory and practice. Vol. 687. John Final Examination: 60%

Wiley & Sons.

4. Mirakhor, A., & Krichene, N. (2014). Introductory

Mathematics and Statistics for Islamic Finance. John

Wiley & Sons.

5. Habib, S. F. (2018). Fundamentals of Islamic Finance

and Banking. John Wiley & Sons.

86